Earning Passive Income Online using Cake DeFi

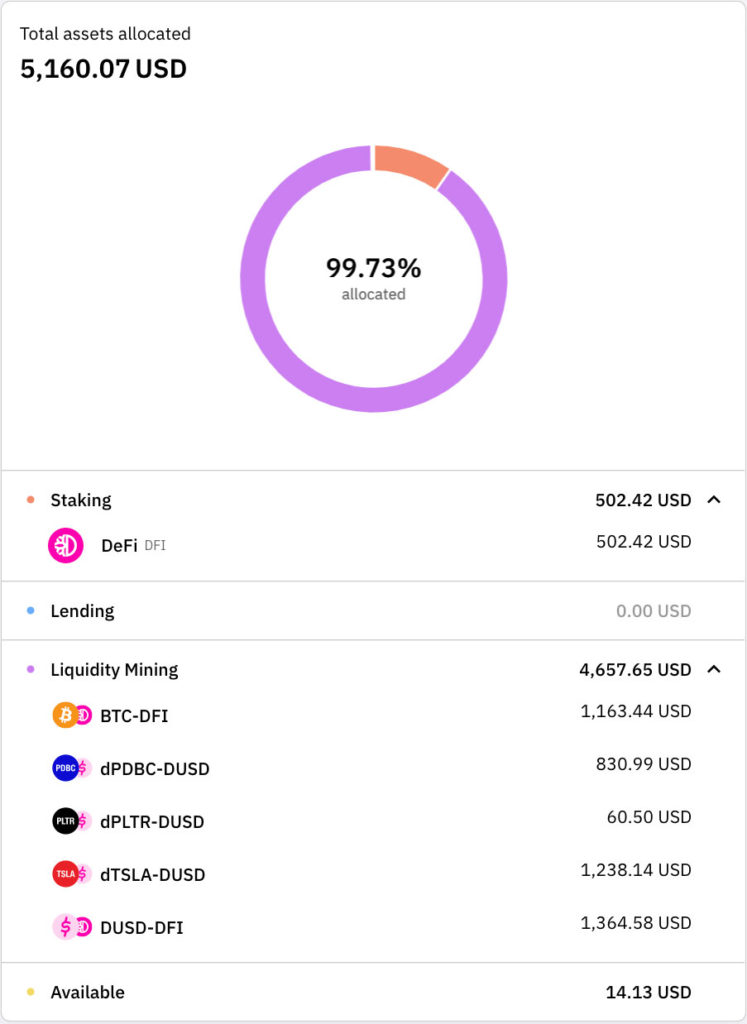

Cake DeFi February earnings is out. Here’s the monthly update on the portfolio we are growing. With ups and downs of crypto prices last February, we managed to earn 374.81 USD around 7.4% return in a month. Below are the updated allocation of the assets. Please note that these are rough figures the price and APY constantly change.

Asset Allocation

There are some adjustment compared to the January allocation.

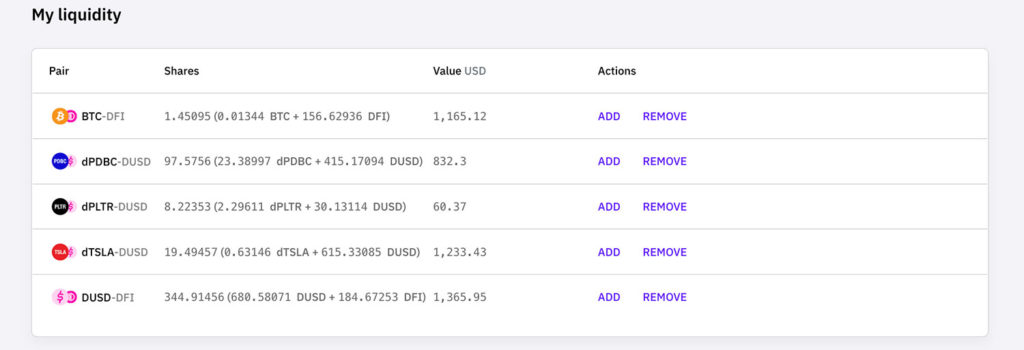

Liquidity Minining

| Pair | Shares |

| BTC-DFI | 1.45095 (0.01344 BTC + 156.62936 DFI) |

| dPDBC-DUSD | 97.5756 (23.38997 dPDBC + 415.17094 DUSD) |

| dPLTR-DUSD | 8.22353 (2.29611 dPLTR + 30.13114 DUSD) |

| dTSLA-DUSD | 19.49457 (0.63146 dTSLA + 615.33085 DUSD) |

| DUSD-DFI | 344.91456 (680.58071 DUSD + 184.67253 DFI) |

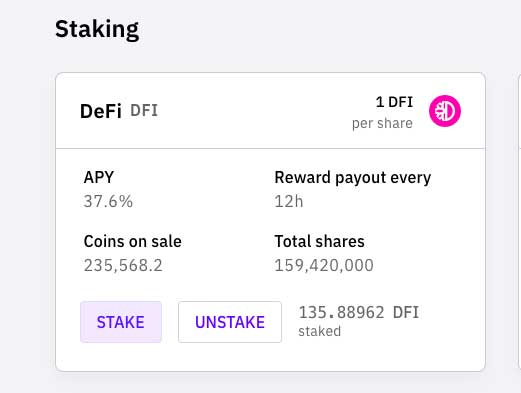

Staking

DFI staked around 135 with 37.6% APY

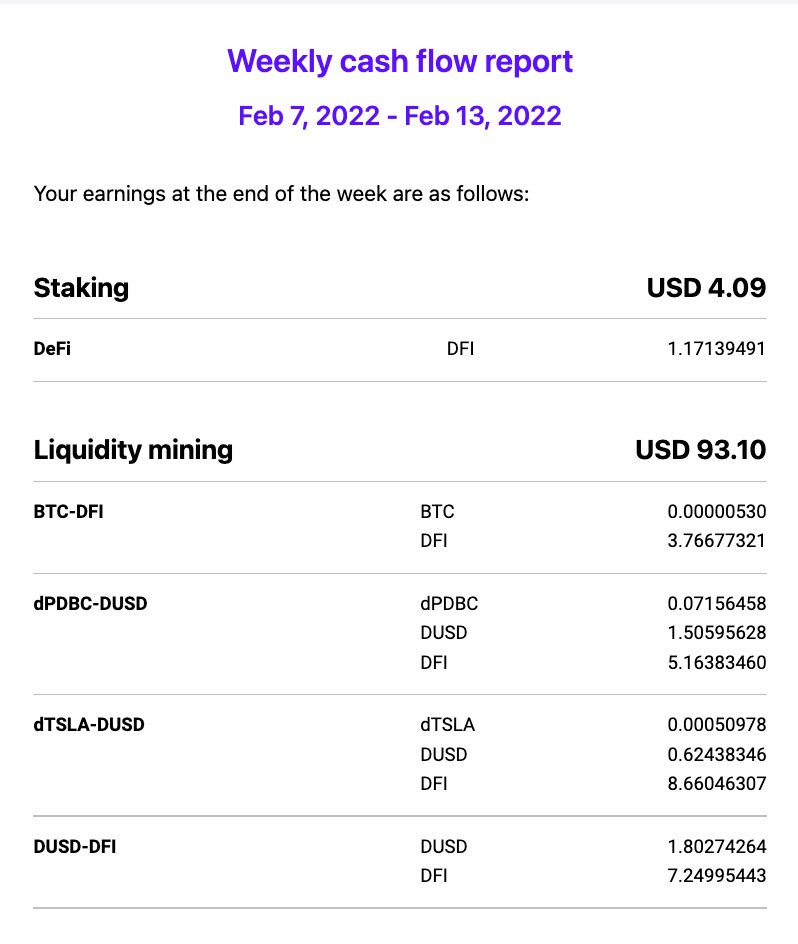

February Cash Flow 2022

Weekly Cash Flow

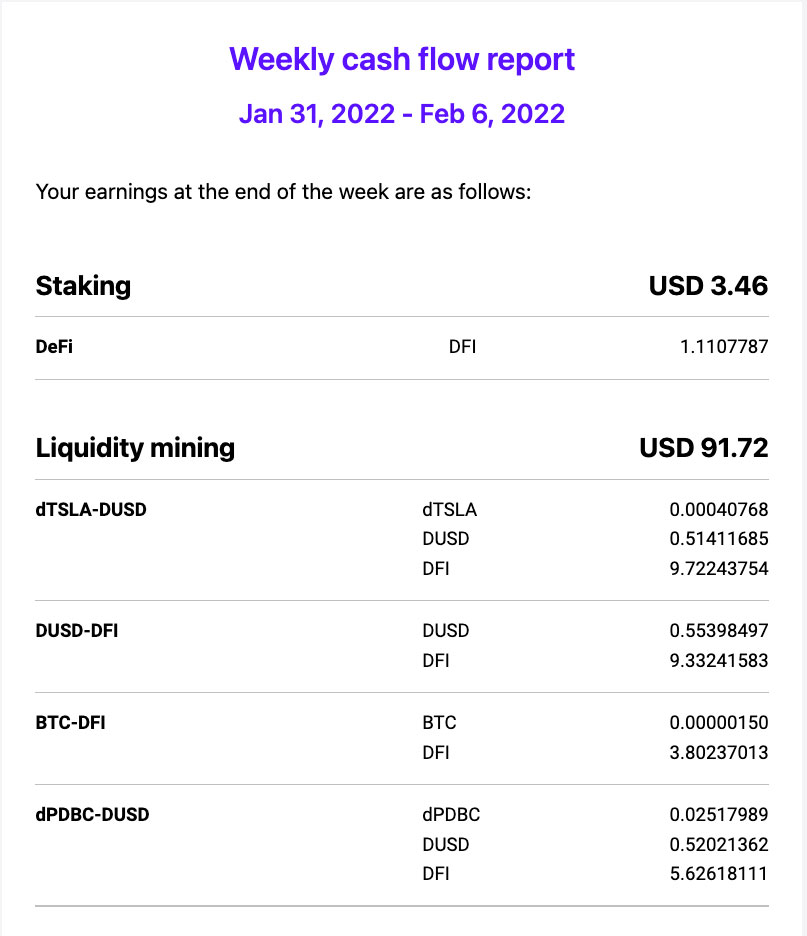

Jan 31 to Feb 6, 2022

Staking – USD 3.46

Liquid Mining – USD 91.72

Feb 7 to 13, 2022

Staking – USD 4.09

Liquid Mining – USD 93.10

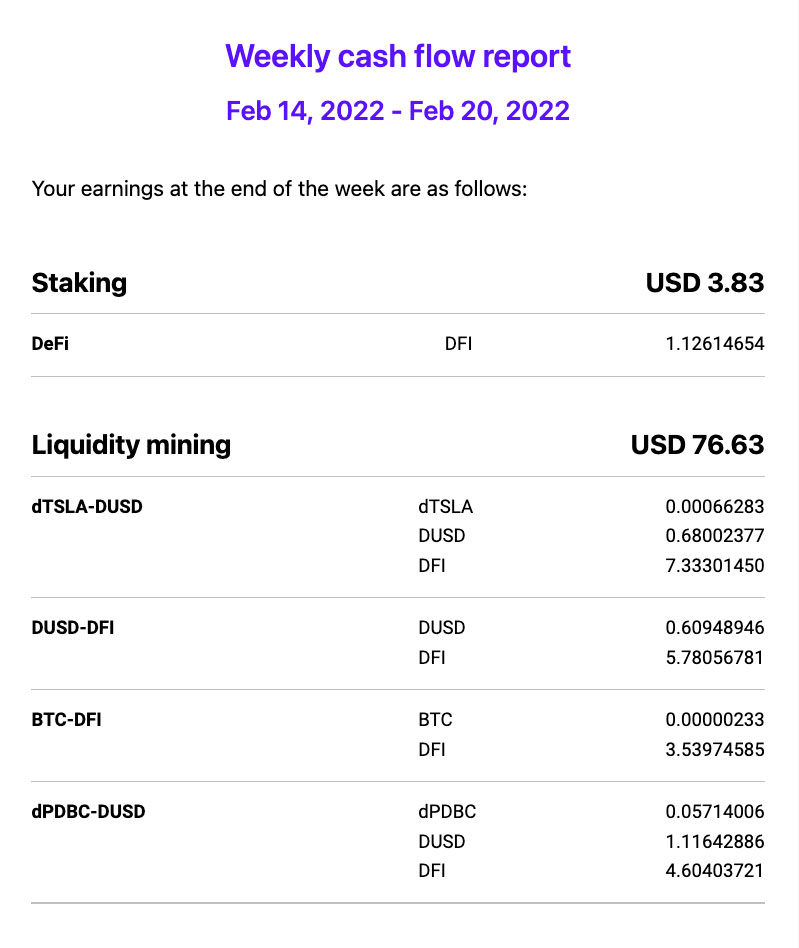

Feb 14 to 20, 2022

Staking – USD 3.83

Liquid Mining – USD 76.63

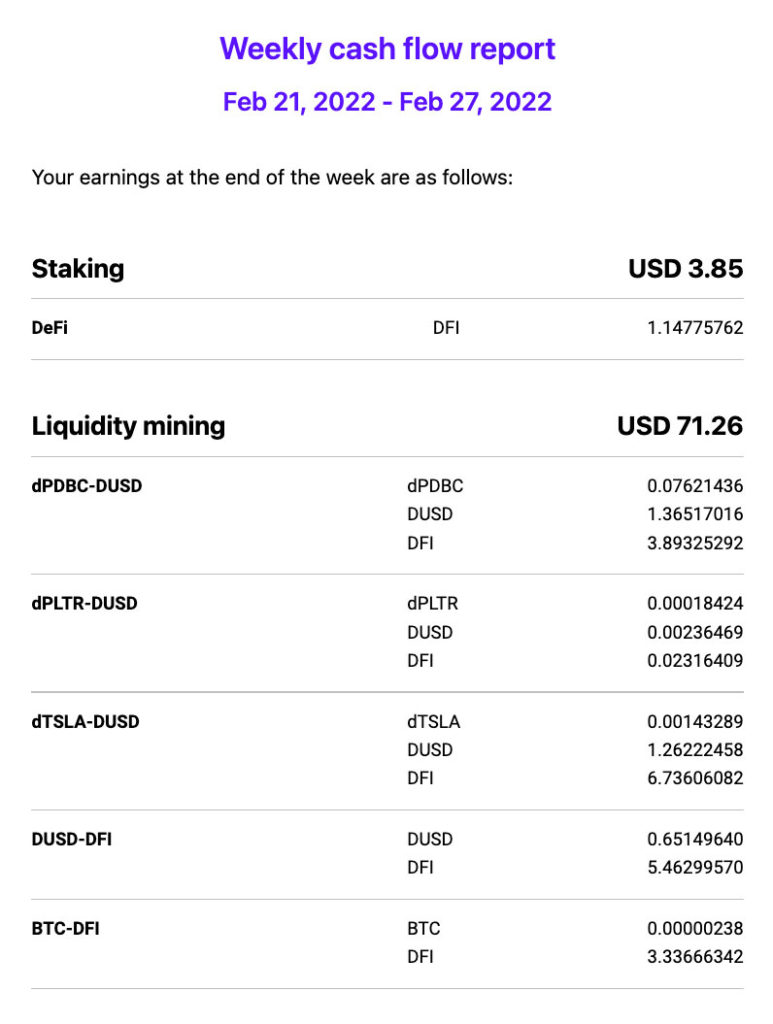

Feb 21 to 27, 2022

Staking – USD 3.85

Liquid Mining – USD 71.26

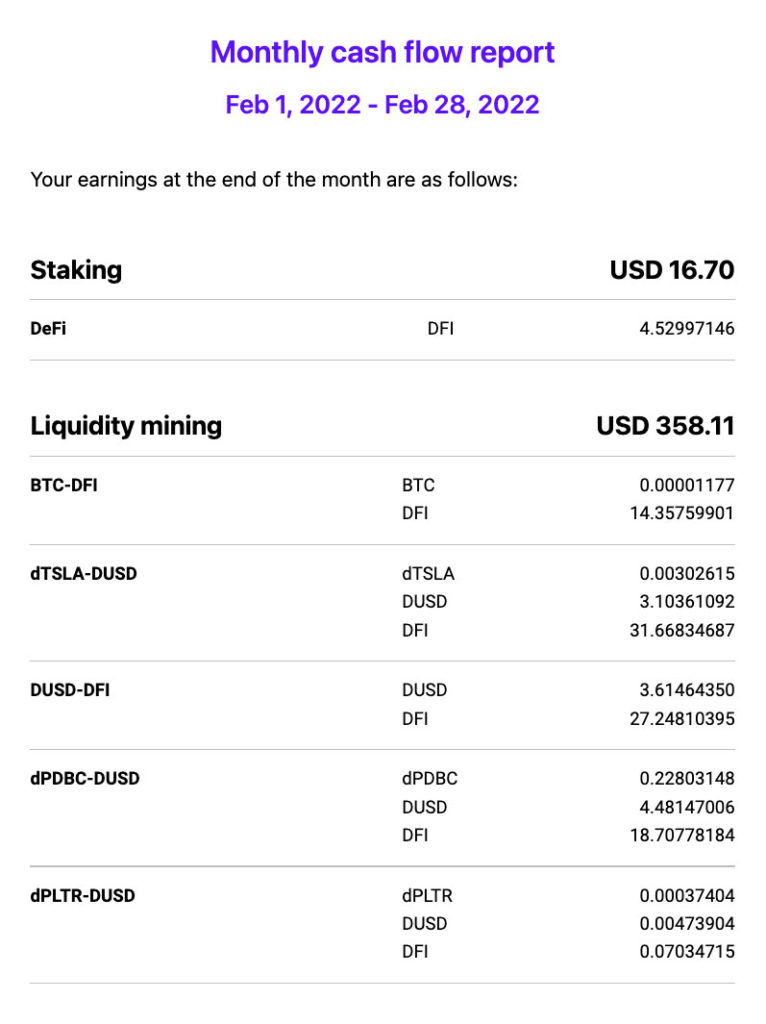

Total February 2022 Cash Flow

Feb 1 to 28, 2022

Staking – USD 16.70

Liquid Mining – USD 358.11

Total cash flow from February 1 to 28 is 374.81 USD (staking + liquidity mining and the freezer bonus)

You can view the January earnings here.

Signup and get $30 signup bonus. Click here.

*Disclaimer: This is for information purposes only and is never intended to be financial investment advice.