As an Overseas Filipino Worker (OFW), saving money can be challenging, especially when you have to support your family back home. However, with the right strategies and mindset, you can make the most out of your earnings and secure your financial future. In this article, I will share some practical tips on how to save money as an OFW.

- Key Takeaways

- Understanding the OFW Lifestyle

- Importance of Financial Planning

- Creating a Budget

- Savings Strategies

- Avoiding Common Financial Mistakes

- Utilizing Financial Tools

- Conclusion

- Frequently Asked Questions

- What are some effective ways to save money as an OFW?

- What are some money-saving tips for OFWs in the Philippines?

- How can OFWs save money on remittance fees?

- What are some practical ways to save money on a daily basis as an OFW?

- What are some cost-saving measures OFWs can implement at home?

- How can OFWs increase their savings and invest in their future?

Understanding the OFW lifestyle is crucial to effective financial planning. The OFW lifestyle is unique, and it involves a lot of sacrifices, hard work, and discipline. As an OFW, you have to deal with homesickness, cultural differences, and the pressure to provide for your family. However, you can use these challenges as motivation to save money and achieve your financial goals.

Importance of Financial Planning

Financial planning is essential for OFWs who want to save money and secure their future. By creating a budget and setting financial goals, you can track your expenses, prioritize your spending, and avoid unnecessary expenses. Financial planning also involves understanding your financial situation, identifying your sources of income, and planning for emergencies.

Key Takeaways

- Understanding the OFW lifestyle is crucial to effective financial planning.

- Financial planning is essential for OFWs who want to save money and secure their future.

- Creating a budget, setting financial goals, and planning for emergencies are key elements of financial planning for OFWs.

Understanding the OFW Lifestyle

As an OFW, I understand that our lifestyle is different from those who work locally. Our job requires us to leave our families and live in a foreign country for an extended period. We work hard to provide for our loved ones back home, and we often sacrifice our own comfort to do so.

Living abroad can be expensive, and we need to be mindful of our spending to make sure that we can send enough money to our families. We also need to be prepared for unexpected expenses, such as medical emergencies or job loss.

To better understand the OFW lifestyle, here are some key points to keep in mind:

-

Higher income: OFWs typically earn higher salaries than they would in the Philippines, but this can vary depending on the country and industry.

-

Living expenses: Living abroad can be expensive, and OFWs need to be mindful of their spending to make sure they can save enough money to send back home.

-

Remittances: OFWs often send a significant portion of their income back to their families in the Philippines to cover expenses such as education, housing, and healthcare.

-

Savings: OFWs need to save money for their own future as well as their families’. This includes setting aside money for emergencies, retirement, and other long-term goals.

-

Challenges: OFWs face a range of challenges, including homesickness, culture shock, language barriers, and discrimination.

By understanding the OFW lifestyle and the unique challenges that come with it, we can better prepare ourselves and make smart financial decisions to ensure our families’ well-being.

Importance of Financial Planning

As an OFW, it is crucial to have a solid financial plan in place to ensure that you are making the most out of your hard-earned money. Financial planning involves defining your goals, understanding your financial picture, and taking steps to advance those goals. It is a process that can help you manage your money and work towards financial milestones.

One of the primary benefits of financial planning is that it helps you prioritize your spending. By creating a budget and sticking to it, you can ensure that you are not overspending on unnecessary items and that you are putting your money towards things that matter most to you, such as your future financial goals.

Another important aspect of financial planning is that it can help you build an emergency fund. As an OFW, it is essential to have a safety net in place in case of unexpected expenses or emergencies. By setting aside at least 30% of your income for your future and having an emergency fund that is around 6 to 12 times your monthly expenses, you can have peace of mind knowing that you are financially prepared for any unforeseen circumstances.

Financial planning can also help you save for retirement, which is important for everyone, including OFWs. By setting aside a portion of your income for retirement, you can ensure that you will have enough money to support yourself and your family when you retire.

In summary, financial planning is essential for OFWs to manage their money effectively, prioritize their spending, build an emergency fund, and save for retirement. By taking the time to create a financial plan and sticking to it, you can ensure that you are making the most out of your hard-earned money and achieving your financial goals.

Creating a Budget

As an OFW, it’s important to create a budget to manage your finances effectively. A budget is a financial plan that helps you prioritize your spending and achieve your financial goals. Here are some tips on how to create a budget:

Identifying Needs and Wants

The first step in creating a budget is to identify your needs and wants. Needs are the essential expenses that you need to survive, such as food, shelter, clothing, and transportation. Wants are the non-essential expenses that you can live without, such as entertainment, dining out, and travel.

To identify your needs and wants, you can make a list of your monthly expenses and categorize them into needs and wants. This will help you determine which expenses are essential and which ones you can cut back on.

Tracking Expenses

The next step in creating a budget is to track your expenses. Tracking your expenses will help you understand where your money is going and identify areas where you can cut back on spending.

To track your expenses, you can use a spreadsheet or a budgeting app to record your income and expenses. Make sure to include all of your expenses, including small purchases like coffee or snacks.

Once you have tracked your expenses for a month or two, you can analyze your spending patterns and identify areas where you can cut back on spending. This will help you create a realistic budget that you can stick to.

In conclusion, creating a budget is an important step in managing your finances as an OFW. By identifying your needs and wants and tracking your expenses, you can create a budget that helps you achieve your financial goals and live within your means.

Savings Strategies

As an OFW, saving money should be a top priority. Here are some effective savings strategies that have worked for me:

Automating Savings

One of the easiest ways to save money is by automating your savings. You can set up automatic transfers from your checking account to your savings account on a regular basis. This way, you won’t have to think about saving money as it will happen automatically. You can also consider setting up automatic contributions to your retirement account, so you can save for your future as well.

Investing in Mutual Funds

Investing in mutual funds is a great way to grow your money over time. It’s a type of investment where your money is pooled with other investors and then invested in a portfolio of stocks, bonds, and other securities. Mutual funds are managed by professional fund managers, so you don’t have to worry about picking individual stocks or bonds yourself. It’s important to do your research and choose a mutual fund that aligns with your investment goals and risk tolerance.

Building an Emergency Fund

An emergency fund is a savings account that you set aside for unexpected expenses, such as medical bills, car repairs, or job loss. It’s important to have an emergency fund to avoid going into debt when unexpected expenses arise. Aim to save at least three to six months’ worth of living expenses in your emergency fund. You can start by setting aside a small amount each month and gradually increasing your savings over time.

By automating your savings, investing in mutual funds, and building an emergency fund, you can set yourself up for financial success as an OFW. Remember to always do your research and seek advice from a financial professional before making any major financial decisions.

Avoiding Common Financial Mistakes

As an OFW, saving money can be challenging, but it’s essential to avoid common financial mistakes. Here are some tips to help avoid debt and resist peer pressure to spend:

Avoiding Debt

One of the biggest mistakes people make is taking on too much debt. It’s essential to live within your means and avoid borrowing more than you can afford to repay. Here are some tips to avoid debt:

- Create a budget: A budget is a plan that helps you manage your money. It’s essential to create a budget and stick to it. Make sure your expenses don’t exceed your income.

- Avoid high-interest loans: High-interest loans can be tempting, but they can quickly spiral out of control. Avoid payday loans, credit card cash advances, and other high-interest loans.

- Pay off debt: If you have debt, focus on paying it off as quickly as possible. Start with the debt that has the highest interest rate.

Resisting Peer Pressure to Spend

It’s easy to get caught up in peer pressure and overspend. Here are some tips to resist peer pressure to spend:

- Prioritize your goals: Set financial goals and prioritize them. It’s easier to resist peer pressure when you have a clear idea of what you want to achieve.

- Say no: It’s okay to say no to social events or activities that don’t fit your budget. Don’t feel pressured to spend money just to fit in.

- Find cheaper alternatives: Look for cheaper alternatives to expensive activities or events. For example, instead of going out for dinner, host a potluck at home.

By avoiding debt and resisting peer pressure to spend, you can save money and achieve your financial goals as an OFW.

Utilizing Financial Tools

As an OFW, I know how challenging it can be to manage finances while working abroad. Fortunately, there are many financial tools available that can help us save money and invest wisely. Here are two of the most useful tools that I have found:

Mobile Banking

Mobile banking is a convenient way to manage our finances on the go. With just a few taps on our smartphones, we can check our account balances, transfer funds, pay bills, and even invest in stocks or mutual funds. Most banks in the Philippines offer mobile banking services, and many of them have user-friendly apps that are easy to navigate.

One of the advantages of mobile banking is that it allows us to avoid long lines at the bank. We can complete most transactions from the comfort of our own homes, without having to take time off from work. Additionally, mobile banking is usually free, and some banks even offer rewards or cashback for using their apps.

Online Investment Platforms

Investing is one of the best ways to grow our wealth over time. However, it can be difficult to know where to start, especially if we are new to investing. That’s where online investment platforms come in. These platforms allow us to invest in stocks, mutual funds, and other financial instruments with just a few clicks.

Some popular online investment platforms in the Philippines include COL Financial, BPI Trade, and First Metro Securities. These platforms offer a range of investment options, from low-risk bonds to high-risk stocks. They also provide research and analysis tools that can help us make informed investment decisions.

One of the advantages of online investment platforms is that they are usually more affordable than traditional brokerage firms. We can start investing with as little as Php 5,000, and many platforms offer low transaction fees and no account maintenance fees.

In conclusion, mobile banking and online investment platforms are two powerful tools that OFWs can use to manage their finances and grow their wealth. By taking advantage of these tools, we can save time, money, and effort while achieving our financial goals.

Conclusion

In conclusion, as an OFW, there are many ways to save money and secure your financial future. By following the tips and strategies outlined in this article, you can take control of your finances and build a better life for yourself and your loved ones.

One of the most important things you can do is to create a budget and stick to it. This will help you track your expenses and identify areas where you can cut back and save money. You can also use tools like mobile apps or online banking to help you manage your finances more effectively.

Another key strategy is to avoid debt whenever possible. This means living within your means and avoiding unnecessary expenses, such as luxury items or expensive vacations. Instead, focus on building an emergency fund and investing in your future through retirement accounts or other long-term savings vehicles.

Finally, it’s important to stay informed and educated about personal finance topics. This can include reading books, attending seminars or webinars, or consulting with a financial advisor. By staying on top of the latest trends and best practices, you can make informed decisions and ensure that your money is working as hard as possible for you.

Overall, saving money as an OFW requires discipline, patience, and a long-term perspective. But with the right mindset and some smart strategies, you can achieve your financial goals and build a brighter future for yourself and your family.

Frequently Asked Questions

What are some effective ways to save money as an OFW?

As an OFW, there are several effective ways to save money. One of the most effective ways is to create a budget and stick to it. You can also automate your savings by setting up a regular transfer to a savings account. Additionally, you can reduce your expenses by avoiding unnecessary purchases and negotiating better deals on your bills.

What are some money-saving tips for OFWs in the Philippines?

One of the best ways to save money as an OFW in the Philippines is to take advantage of discounts and promotions offered by stores and businesses. You can also save money on transportation by using public transportation or carpooling. Another tip is to cook your own meals instead of eating out.

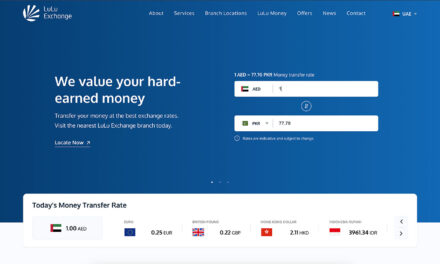

How can OFWs save money on remittance fees?

OFWs can save money on remittance fees by comparing fees and exchange rates offered by different remittance providers. You can also consider using online money transfer services, which often offer lower fees and better exchange rates.

What are some practical ways to save money on a daily basis as an OFW?

To save money on a daily basis as an OFW, you can pack your own lunch instead of eating out, use coupons and discounts when shopping, and avoid unnecessary purchases. You can also save money on utilities by turning off lights and appliances when not in use.

What are some cost-saving measures OFWs can implement at home?

To save money at home, OFWs can implement cost-saving measures such as using energy-efficient appliances, turning off lights and appliances when not in use, and reducing water usage. You can also consider growing your own vegetables and fruits to save money on groceries.

How can OFWs increase their savings and invest in their future?

OFWs can increase their savings by setting financial goals, creating a budget, and automating their savings. You can also consider investing in stocks, mutual funds, or real estate to grow your wealth over time. It’s important to consult with a financial advisor before making any investment decisions.