A forex broker is a financial services company that provides traders with access to a platform for buying and selling foreign currencies. Forex brokers typically offer a range of services, including access to trading platforms, educational resources, market analysis, and customer support. They may also offer various types of accounts with different trading conditions, such as leverage and spreads. Forex brokers earn revenue by charging traders fees or commissions on their trades, and by earning interest on traders’ account balances. Here are the list of Top 10 Forex Brokers in the UAE.

- 1. IG – Best overall broker, most trusted

- 2. Saxo Bank – Best web-based trading platform

- 3. FOREX.com

- 4. XTB – Great Research and Education

- 5. Swissquote – Trusted Broker, Best Banking Services

- 6. AvaTrade – Great for Beginners and Copy Trading

- 7. IC Markets – Competitive Offers for Forex, CFDs, Spread Betting, Share Dealing, Cryptocurrencies

- 8. Roboforex – Offers Forex, CFDs

- 9. XM – Good Trading Platform Options (MT4 and MT5), Tight Spreads Plus Excellent Customer Service

- 10. eToro – Best Broker in UAE For Beginners

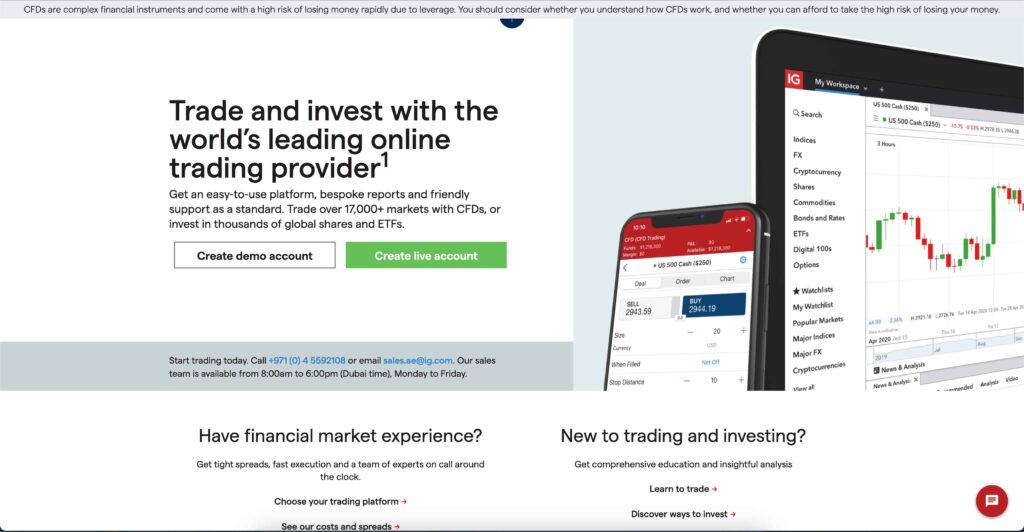

1. IG – Best overall broker, most trusted

IG is a multi-asset broker that is publicly traded and regulated across the globe. Founded in 1974, the broker has the trust of decades and is considered one of the largest and most trusted forex brokers in the world.

Awards and Recognition

IG has won numerous awards over the years, including the coveted award for the best overall forex broker by ForexBrokers.com in 2023. With a trust score of 99, IG is recognized as one of the most trusted brokers in the industry.

Trading Experience

IG delivers a fantastic all-around trading experience. The broker offers a wide range of trading instruments, including forex, CFDs, shares, indices, commodities, and cryptocurrencies. With over 19537 tradeable symbols, IG provides traders with a diverse range of options to choose from.

The broker also offers a range of trading platforms, including its proprietary platform, the IG Trading Platform, as well as the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

IG’s trading platforms are user-friendly and provide traders with a range of tools and features to help them make informed trading decisions. The broker also offers a range of educational resources, including webinars, trading guides, and a trading glossary, to help traders improve their skills and knowledge.

Trust and Security

IG is a trusted and secure broker that is regulated by top-tier regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS).

The broker also offers negative balance protection, which ensures that traders cannot lose more than their account balance. This provides traders with an added layer of security and helps to protect them from significant losses.

Pros and Cons

IG Pros

- IG is a trusted and secure broker that is regulated by top-tier regulatory bodies, including the FCA in the UK, ASIC, and MAS.

- IG offers a wide range of trading instruments, including forex, CFDs, shares, indices, commodities, and cryptocurrencies.

- IG provides traders with a diverse range of options to choose from, with over 19537 tradeable symbols.

- IG’s trading platforms are user-friendly and provide traders with a range of tools and features to help them make informed trading decisions.

- IG offers a range of educational resources, including webinars, trading guides, and a trading glossary, to help traders improve their skills and knowledge.

- IG has won numerous awards over the years, including the coveted award for the best overall forex broker by ForexBrokers.com in 2023.

IG Cons

- IG’s spreads can be higher than some of its competitors.

- IG charges an inactivity fee if an account is inactive for two years or more.

- IG’s customer support can be slow to respond at times.

Overall, the pros of IG far outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, and range of trading instruments and educational resources make it a reliable choice for traders looking for a safe and secure trading environment.

IG Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Retail/Professional |

| Minimum Deposit | $0 |

| Inactivity Fee | $12/£12/€14 per month after two years of inactivity |

| Trading Fees | From $10 USD |

| Spread | From 0.08 pips |

| Commission | Free trading depending on the account traders select |

| Conversion Fee | £100 (including VAT) to convert physical shares into electronic form and £100 (including VAT) to convert electronic shares into physical form |

| Custody Fee | N/A |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the IG website for the most up-to-date and accurate fee information.

Conclusion

Overall, IG is a top-tier broker that offers an excellent all-around trading experience. With its wide range of trading instruments, user-friendly trading platforms, and educational resources, IG is an excellent choice for both beginner and experienced traders. The broker’s trustworthiness and security make it a reliable choice for traders looking for a safe and secure trading environment.

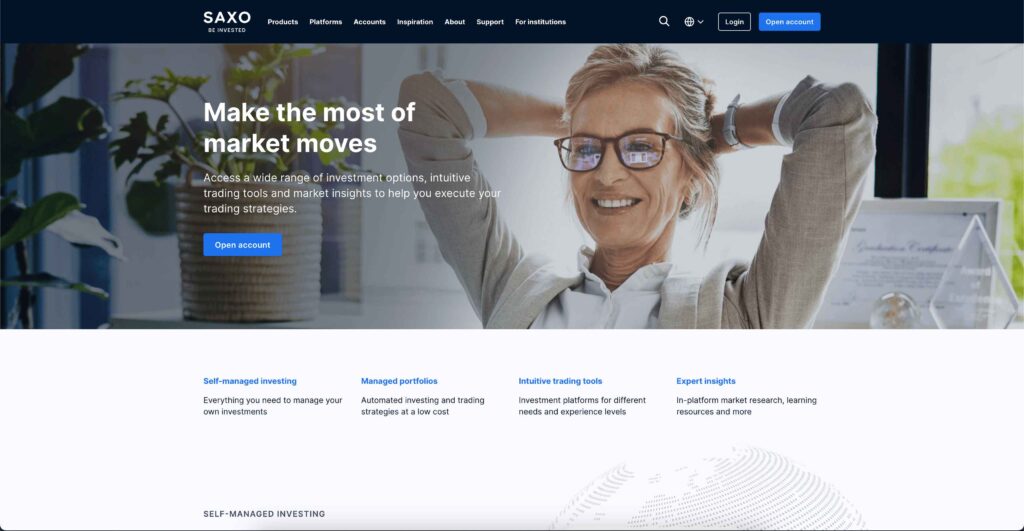

2. Saxo Bank – Best web-based trading platform

Saxo Bank is a Danish investment bank that was founded in 1992. The bank provides online trading and investment services to institutional and retail clients worldwide. Saxo Bank is regulated by top-tier regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Danish Financial Supervisory Authority (FSA).

Awards and Recognition

Saxo Bank has won numerous awards over the years, including the Best Web-Based Trading Platform by ForexBrokers.com in 2023. The bank has also been recognized for its innovative trading technology, with awards such as Best Platform Technology by the Benzinga Global Fintech Awards in 2022.

Trading Experience

Saxo Bank offers a wide range of trading instruments, including forex, CFDs, stocks, futures, options, bonds, and ETFs. The bank provides traders with access to over 40,000 instruments across global financial markets.

Saxo Bank’s trading platform, SaxoTraderGO, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions. The platform offers advanced charting tools, real-time news, and analysis, and a range of order types to help traders execute their trades.

Saxo Bank also offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

Trust and Security

Saxo Bank is a trusted and secure broker that is regulated by top-tier regulatory bodies. The bank also offers negative balance protection, which ensures that traders cannot lose more than their account balance. This provides traders with an added layer of security and helps to protect them from significant losses.

Saxo Bank Pros and Cons

Pros

- Saxo Bank is a trusted and secure broker that is regulated by top-tier regulatory bodies, including the FCA in the UK and the Danish FSA.

- Saxo Bank offers a wide range of trading instruments, including forex, CFDs, stocks, futures, options, bonds, and ETFs.

- Saxo Bank provides traders with access to over 40,000 instruments across global financial markets.

- Saxo Bank’s trading platform, SaxoTraderGO, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions.

- Saxo Bank offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

- Saxo Bank has won numerous awards over the years, including the Best Web-Based Trading Platform by ForexBrokers.com in 2023.

Cons

- Saxo Bank can be expensive for certain trading instruments, such as bonds, options, and futures.

- Non-trading fees, such as the custody and inactivity fee, can make Saxo Bank expensive for buy and hold investors.

- Saxo Bank’s customer support can be slow to respond at times.

Overall, the pros of Saxo Bank outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, range of trading instruments, and educational resources make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher fees in certain trading instruments and non-trading fees.

Saxo Bank fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Classic, Platinum, VIP |

| Minimum Deposit | $10,000 for Classic, $200,000 for Platinum, $1,000,000 for VIP |

| Inactivity Fee | $100 per 6 months after 12 months of inactivity |

| Trading Fees | From $3 per trade |

| Spread | From 0.4 pips |

| Commission | From $6 per trade |

| Conversion Fee | 0.5% |

| Custody Fee | 0.12% per annum on the value of assets held |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the Saxo Bank website for the most up-to-date and accurate fee information.

Conclusion

Overall, Saxo Bank is a top-tier broker that offers an excellent trading experience. With its wide range of trading instruments, user-friendly trading platform, and educational resources, Saxo Bank is an excellent choice for both beginner and experienced traders. The bank’s trustworthiness and security make it a reliable choice for traders looking for a safe and secure trading environment.

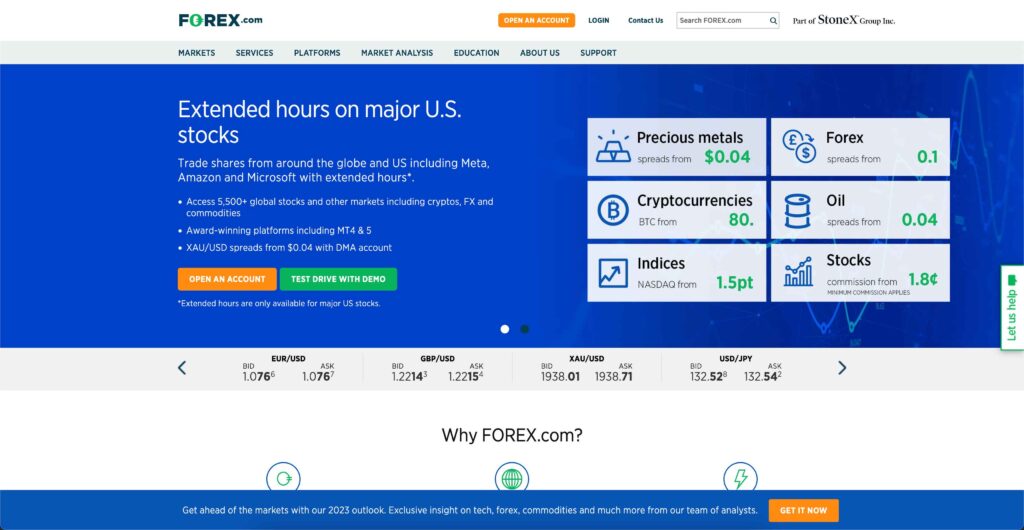

3. FOREX.com

FOREX.com is a global forex and CFD broker that provides online trading services to institutional and retail clients worldwide. The broker is regulated by top-tier regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Commodity Futures Trading Commission (CFTC) in the US.

Awards and Recognition

FOREX.com has won numerous awards over the years, including the Best Overall Forex Broker by ForexBrokers.com in 2023. The broker has also been recognized for its innovative trading technology, with awards such as Best Mobile Platform by the Online Personal Wealth Awards in 2022.

Trading Experience

FOREX.com offers a wide range of trading instruments, including forex, CFDs, stocks, commodities, and cryptocurrencies. The broker provides traders with access to over 300 tradeable instruments across global financial markets.

FOREX.com’s trading platform, Advanced Trading Platform, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions. The platform offers advanced charting tools, real-time news, and analysis, and a range of order types to help traders execute their trades.

FOREX.com also offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

Trust and Security

FOREX.com is a trusted and secure broker that is regulated by top-tier regulatory bodies. The broker also offers negative balance protection, which ensures that traders cannot lose more than their account balance. This provides traders with an added layer of security and helps to protect them from significant losses.

Pros and cons

Pros

- FOREX.com is a trusted and secure broker that is regulated by top-tier regulatory bodies, including the FCA in the UK, ASIC, and CFTC in the US.

- FOREX.com offers a wide range of trading instruments, including forex, CFDs, stocks, commodities, and cryptocurrencies.

- FOREX.com provides traders with access to over 300 tradeable instruments across global financial markets.

- FOREX.com’s trading platform, Advanced Trading Platform, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions.

- FOREX.com offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

- FOREX.com has won numerous awards over the years, including the Best Overall Forex Broker by ForexBrokers.com in 2023.

Cons

- FOREX.com’s spreads can be higher than some of its competitors.

- FOREX.com charges an inactivity fee if an account is inactive for one year or more.

- FOREX.com’s customer support can be slow to respond at times.

Overall, the pros of FOREX.com outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, range of trading instruments, and educational resources make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher spreads and the inactivity fee.

Forex.com Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Standard, Commission, Direct Market Access |

| Minimum Deposit | $50 for Standard, $1,000 for Commission, $25,000 for Direct Market Access |

| Inactivity Fee | $15 per month after one year of inactivity |

| Trading Fees | From $5 per trade |

| Spread | From 0.2 pips |

| Commission | From $5 per trade |

| Conversion Fee | 0.1% |

| Custody Fee | N/A |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the FOREX.com website for the most up-to-date and accurate fee information.

Conclusion

Overall, FOREX.com is a top-tier broker that offers an excellent trading experience. With its wide range of trading instruments, user-friendly trading platform, and educational resources, FOREX.com is an excellent choice for both beginner and experienced traders. The broker’s trustworthiness and security make it a reliable choice for traders looking for a safe and secure trading environment.

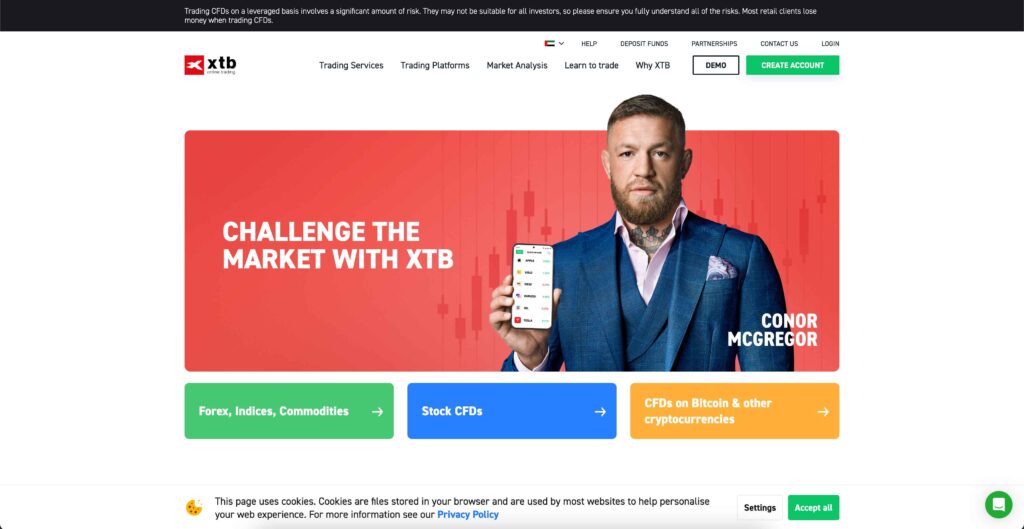

4. XTB – Great Research and Education

XTB is a global online broker that provides trading and investment services to institutional and retail clients worldwide. The broker is regulated by top-tier regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Polish Financial Supervision Authority (KNF), and the Cyprus Securities and Exchange Commission (CySEC).

Research

XTB is known for its excellent research capabilities, providing traders with access to a range of research tools and resources to help them make informed trading decisions. The broker offers daily market analysis, economic calendars, and trading signals to help traders stay up-to-date with the latest market developments.

XTB also provides traders with access to a range of research reports, including technical analysis, fundamental analysis, and market sentiment reports. These reports are created by XTB’s team of expert analysts and are designed to provide traders with insights into the markets and help them identify potential trading opportunities.

Education

XTB is committed to providing traders with the education and resources they need to succeed in the markets. The broker offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

XTB’s trading academy is a comprehensive educational resource that covers a range of topics, including trading strategies, technical analysis, and risk management. The academy is designed to cater to traders of all levels, from beginner to advanced, and provides traders with the knowledge and skills they need to succeed in the markets.

Pros and Cons

Pros

- XTB is a trusted and secure broker that is regulated by top-tier regulatory bodies, including the FCA in the UK, KNF in Poland, and CySEC in Cyprus.

- XTB offers a wide range of trading instruments, including forex, CFDs, stocks, commodities, and cryptocurrencies.

- XTB provides traders with access to over 1,500 tradeable instruments across global financial markets.

- XTB’s trading platform, xStation 5, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions.

- XTB offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

- XTB is known for its excellent research capabilities, providing traders with access to a range of research tools and resources to help them make informed trading decisions.

Cons

- XTB focuses mainly on CFDs, which are risky instruments. Traders should be careful when trading CFDs.

- XTB’s fees for certain trading instruments, such as stock CFDs and ETF CFDs, may be higher compared to some of its competitors.

- XTB’s customer support can be slow to respond at times.

Overall, the pros of XTB outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, range of trading instruments, educational resources, and research capabilities make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher fees in certain trading instruments and the risks associated with trading CFDs.

XTB Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Standard, Pro |

| Minimum Deposit | $0 for Standard, $2,000 for Pro |

| Inactivity Fee | $10 per month after one year of inactivity |

| Trading Fees | From $3.5 per lot |

| Spread | From 0.1 pips |

| Commission | From $3.5 per lot |

| Conversion Fee | 0.5% |

| Custody Fee | N/A |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the XTB website for the most up-to-date and accurate fee information.

Conclusion

Overall, XTB is a top-tier broker that offers excellent research and education capabilities. With its daily market analysis, research reports, and educational resources, XTB is an excellent choice for traders looking for a broker that provides them with the tools and resources they need to succeed in the markets. The broker’s trustworthiness and security make it a reliable choice for traders looking for a safe and secure trading environment. www.xtb.com

5. Swissquote – Trusted Broker, Best Banking Services

Swissquote is a leading online broker that provides trading and investment services to institutional and retail clients worldwide. The broker is regulated by top-tier regulatory bodies, including the Swiss Financial Market Supervisory Authority (FINMA) and the Financial Conduct Authority (FCA) in the UK.

Trust and Security

Swissquote is a trusted and secure broker that is regulated by top-tier regulatory bodies. The broker also offers negative balance protection, which ensures that traders cannot lose more than their account balance. This provides traders with an added layer of security and helps to protect them from significant losses.

Banking Services

Swissquote is also known for its excellent banking services, providing traders with access to a range of banking products and services. The broker offers a range of banking services, including eForex, ePrivate Banking, eMortgage, and flexible saving accounts.

Swissquote’s ePrivate Banking service is a comprehensive banking service that provides clients with access to a range of investment products and services. The service is designed to cater to high-net-worth individuals and provides them with the expertise and knowledge they need to make informed investment decisions.

Trading Experience

Swissquote offers a wide range of trading instruments, including forex, CFDs, stocks, futures, options, bonds, and ETFs. The broker provides traders with access to over 130 tradeable instruments across global financial markets.

Swissquote’s trading platform, Swissquote Advanced Trader, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions. The platform offers advanced charting tools, real-time news, and analysis, and a range of order types to help traders execute their trades.

Swissquote also offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

Swissquote pros and cons

Pros

- A trusted and secure broker that is regulated by top-tier regulatory bodies, including FINMA and the FCA.

- Offers a wide range of trading instruments, including forex, CFDs, stocks, futures, options, bonds, and ETFs.

- Provides traders with access to over 130 tradeable instruments across global financial markets.

- Swissquote’s trading platform, Swissquote Advanced Trader, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions.

- Offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

- Swissquote is known for its excellent banking services, providing traders with access to a range of banking products and services, including ePrivate Banking.

Cons

- Swissquote’s trading fees can be higher than some of its competitors.

- Swissquote’s customer support can be slow to respond at times.

- Swissquote’s trading platform selection can be confusing for some traders.

Overall, the pros of Swissquote outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, range of trading instruments, educational resources, and banking services make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher trading fees and the potential for confusion when selecting a trading platform.

Swissquote Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Standard, Premium, Prime |

| Minimum Deposit | $1,000 for Premium, $10,000 for Prime |

| Inactivity Fee | CHF 15 per month after one year of inactivity |

| Trading Fees | From $9 per trade |

| Spread | From 0.6 pips |

| Commission | From $7 per trade |

| Conversion Fee | 0.5% |

| Custody Fee | From CHF 15 per month |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the Swissquote website for the most up-to-date and accurate fee information.

Conclusion

Overall, Swissquote is a top-tier broker that offers excellent banking services and a comprehensive trading experience. With its wide range of trading instruments, user-friendly trading platform, and educational resources, Swissquote is an excellent choice for both beginner and experienced traders. The broker’s trustworthiness and security make it a reliable choice for traders looking for a safe and secure trading environment. www.swissquote.com

6. AvaTrade – Great for Beginners and Copy Trading

AvaTrade is a leading online broker that provides trading and investment services to institutional and retail clients worldwide. The broker is regulated by top-tier regulatory bodies, including the Central Bank of Ireland, the Financial Sector Conduct Authority (FSCA) in South Africa, and the Australian Securities and Investments Commission (ASIC).

Beginner-Friendly

AvaTrade is an excellent choice for beginner traders, providing them with a user-friendly trading platform and a range of educational resources to help them improve their skills and knowledge. The broker offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders learn about the markets and improve their trading skills.

AvaTrade’s trading platform, AvaTradeGO, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions. The platform offers advanced charting tools, real-time news, and analysis, and a range of order types to help traders execute their trades.

Copy Trading

AvaTrade is also known for its excellent copy trading capabilities, providing traders with access to a range of copy trading platforms, including ZuluTrade and DupliTrade. These platforms allow traders to copy the trades of successful traders and investors, providing them with an added layer of security and helping them to make informed trading decisions.

AvaTrade also offers a range of signal providers to choose from on its AvaSocial app, providing traders with a large variety of options to choose from. The broker also provides in-platform, live trade alerts on its WebTrader and award-winning AvaTradeGO platforms.

Trading Experience

AvaTrade offers a wide range of trading instruments, including forex, CFDs, stocks, commodities, and cryptocurrencies. The broker provides traders with access to over 250 tradeable instruments across global financial markets.

AvaTrade’s trading platform, AvaTradeGO, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions. The platform offers advanced charting tools, real-time news, and analysis, and a range of order types to help traders execute their trades.

AvaTrade Pros and Cons

Pros

- AvaTrade is a trusted and secure broker that is regulated by top-tier regulatory bodies, including the Central Bank of Ireland, FSCA, and ASIC.

- AvaTrade offers a wide range of trading instruments, including forex, CFDs, stocks, commodities, and cryptocurrencies.

- AvaTrade provides traders with access to over 250 tradeable instruments across global financial markets.

- AvaTrade’s trading platform, AvaTradeGO, is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions.

- AvaTrade offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

- AvaTrade is known for its excellent copy trading capabilities, providing traders with access to a range of copy trading platforms, including ZuluTrade and DupliTrade.

Cons

- AvaTrade’s fees for certain trading instruments, such as stock CFDs, may be higher compared to some of its competitors.

- AvaTrade’s customer support can be slow to respond at times.

- AvaTrade’s trading platform selection can be limited for experienced traders.

Overall, the pros of AvaTrade outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, range of trading instruments, educational resources, and copy trading capabilities make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher fees in certain trading instruments and the limited platform selection for experienced traders.

AvaTrade Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Retail, Professional |

| Minimum Deposit | $100 for Retail, $1,000 for Professional |

| Inactivity Fee | $50 per quarter after three months of inactivity |

| Trading Fees | From $0 |

| Spread | From 0.9 pips |

| Commission | From $0 |

| Conversion Fee | 0.5% |

| Custody Fee | N/A |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the AvaTrade website for the most up-to-date and accurate fee information.

Conclusion

Overall, AvaTrade is a top-tier broker that is great for beginner traders and copy trading. With its user-friendly trading platform, educational resources, and copy trading capabilities, AvaTrade is an excellent choice for both beginner and experienced traders. www.avatrade.com

7. IC Markets – Competitive Offers for Forex, CFDs, Spread Betting, Share Dealing, Cryptocurrencies

IC Markets is a leading online broker that provides trading and investment services to institutional and retail clients worldwide. The broker is regulated by top-tier regulatory bodies, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK.

Competitive Offers

IC Markets is known for its competitive offers, providing traders with access to a wide range of trading instruments, including forex, CFDs, spread betting, share dealing, and cryptocurrencies. The broker offers over 230 tradeable instruments across global financial markets.

IC Markets’ trading platform, MetaTrader 4 (MT4), is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions. The platform offers advanced charting tools, real-time news and analysis, and a range of order types to help traders execute their trades.

IC Markets also offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

Forex Trading

IC Markets is an excellent choice for forex traders, providing them with access to over 60 currency pairs across global financial markets. The broker offers competitive spreads and fast execution speeds, providing traders with an added layer of security and helping them to make informed trading decisions.

IC Markets also offers a range of forex trading tools, including the Autochartist tool, which provides traders with real-time market analysis and trading signals.

Cryptocurrency Trading

IC Markets is also known for its excellent cryptocurrency trading capabilities, providing traders with access to a range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. The broker offers competitive spreads and fast execution speeds, providing traders with an added layer of security and helping them to make informed trading decisions.

IC Markets also offers a range of cryptocurrency trading tools, including the Autochartist tool, which provides traders with real-time market analysis and trading signals.

IC Markets Pros and Cons

Pros

- IC Markets is a trusted and secure broker that is regulated by top-tier regulatory bodies, including ASIC and FCA.

- IC Markets offers a wide range of trading instruments, including forex, CFDs, spread betting, share dealing, and cryptocurrencies.

- IC Markets provides traders with access to over 230 tradeable instruments across global financial markets.

- IC Markets’ trading platform, MetaTrader 4 (MT4), is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions.

- IC Markets offers competitive spreads and fast execution speeds, providing traders with an added layer of security and helping them to make informed trading decisions.

- IC Markets offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

Cons

- IC Markets’ fees for certain trading instruments, such as share dealing, may be higher compared to some of its competitors.

- IC Markets’ customer support can be slow to respond at times.

- IC Markets’ trading platform selection can be limited for experienced traders.

Overall, the pros of IC Markets outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, range of trading instruments, competitive trading conditions, and educational resources make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher fees in certain trading instruments and the limited platform selection for experienced traders.

IC Markets Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Raw Spread Account, Standard Account, cTrader Account |

| Minimum Deposit | $200 for Raw Spread Account and Standard Account, $1,000 for cTrader Account |

| Inactivity Fee | $15 per month after two years of inactivity |

| Trading Fees | From $3 per lot |

| Spread | From 0.0 pips |

| Commission | From $3 per lot |

| Conversion Fee | 1.0% |

| Custody Fee | N/A |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the IC Markets website for the most up-to-date and accurate fee information.

Conclusion

Overall, IC Markets is a top-tier broker that offers competitive offers for forex, CFDs, spread betting, share dealing, and cryptocurrencies. With its user-friendly trading platform, educational resources, and competitive trading conditions, IC Markets is an excellent choice for both beginner and experienced traders. The broker’s trustworthiness and security make it a reliable choice for traders looking for a safe and secure trading environment. www.icmarkets.com

8. Roboforex – Offers Forex, CFDs

Roboforex is a global broker that offers trading and investment services to institutional and retail clients worldwide. The broker is regulated by top-tier regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the International Financial Services Commission (IFSC) in Belize.

Trading Instruments

Roboforex offers a wide range of trading instruments, including forex, CFDs, and cryptocurrencies. The broker provides traders with access to over 12,000 tradeable instruments across global financial markets.

Roboforex’s trading platform, MetaTrader 4 (MT4), is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions. The platform offers advanced charting tools, real-time news, and analysis, and a range of order types to help traders execute their trades.

Forex Trading

Roboforex is an excellent choice for forex traders, providing them with access to over 40 currency pairs across global financial markets. The broker offers competitive spreads and fast execution speeds, providing traders with an added layer of security and helping them to make informed trading decisions.

Roboforex also offers a range of forex trading tools, including the Autochartist tool, which provides traders with real-time market analysis and trading signals.

Cryptocurrency Trading

Roboforex is also known for its excellent cryptocurrency trading capabilities, providing traders with access to a range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. The broker offers competitive spreads and fast execution speeds, providing traders with an added layer of security and helping them to make informed trading decisions.

Roboforex also offers a range of cryptocurrency trading tools, including the Autochartist tool, which provides traders with real-time market analysis and trading signals.

Roboforex pros and cons

Pros

- Roboforex is a trusted and secure broker that is regulated by top-tier regulatory bodies, including CySEC and IFSC.

- Roboforex offers a wide range of trading instruments, including forex, CFDs, and cryptocurrencies.

- Roboforex provides traders with access to over 12,000 tradeable instruments across global financial markets.

- Roboforex’s trading platform, MetaTrader 4 (MT4), is a user-friendly platform that provides traders with a range of tools and features to help them make informed trading decisions.

- Roboforex offers competitive spreads and fast execution speeds, providing traders with an added layer of security and helping them to make informed trading decisions.

- Roboforex offers a range of trading tools, including the Autochartist tool, to help traders improve their trading skills and knowledge.

Cons

- Roboforex’s fees for certain trading instruments, such as cryptocurrencies, may be higher compared to some of its competitors.

- Roboforex’s customer support can be slow to respond at times.

- Roboforex’s trading platform selection can be limited for experienced traders.

Overall, the pros of Roboforex outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, range of trading instruments, competitive trading conditions, and trading tools make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher fees in certain trading instruments and the limited platform selection for experienced traders.

Roboforex Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Pro-Standard, Pro-Cent, ECN-Pro NDD, Prime |

| Minimum Deposit | $10 for Pro-Standard and Pro-Cent, $500 for ECN-Pro NDD, $5,000 for Prime |

| Inactivity Fee | $10 per month after one year of inactivity |

| Trading Fees | From $10 per lot |

| Spread | From 0.0 pips |

| Commission | From $10 per lot |

| Conversion Fee | 1.0% |

| Custody Fee | N/A |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the Roboforex website for the most up-to-date and accurate fee information.

Conclusion

Overall, Roboforex is a top-tier broker that offers trading services for forex, CFDs, and cryptocurrencies. With its user-friendly trading platform, competitive trading conditions, and a wide range of trading instruments, Roboforex is an excellent choice for both beginner and experienced traders. The broker’s trustworthiness and security make it a reliable choice for traders looking for a safe and secure trading environment. www.roboforex.com

9. XM – Good Trading Platform Options (MT4 and MT5), Tight Spreads Plus Excellent Customer Service

XM is a leading online broker that provides trading and investment services to institutional and retail clients worldwide. The broker is regulated by top-tier regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Trading Platform Options

XM offers a range of trading platform options, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both platforms are user-friendly and provide traders with a range of tools and features to help them make informed trading decisions.

MT4 is a widely-used platform that offers advanced charting tools, real-time news and analysis, and a range of order types to help traders execute their trades. MT5, on the other hand, offers additional features, including more advanced charting tools, more order types, and the ability to trade futures and options.

Tight Spreads

XM offers tight spreads on a range of trading instruments, including forex, CFDs, and cryptocurrencies. The broker’s competitive spreads provide traders with an added layer of security and help them to make informed trading decisions.

Excellent Customer Service

XM is known for its excellent customer service, providing traders with 24/5 customer support via live chat, email, and phone. The broker’s customer support team is knowledgeable and responsive, providing traders with the assistance they need to navigate the trading platform and make informed trading decisions.

Trading Instruments

XM offers a wide range of trading instruments, including forex, CFDs, commodities, stocks, and cryptocurrencies. The broker provides traders with access to over 1,000 tradeable instruments across global financial markets.

XM Pros and Cons

Pros

- XM is a trusted and secure broker that is regulated by top-tier regulatory bodies, including the FCA and CySEC.

- XM offers a range of trading platform options, including MT4 and MT5, which are user-friendly and provide traders with a range of tools and features to help them make informed trading decisions.

- XM offers tight spreads on a range of trading instruments, including forex, CFDs, and cryptocurrencies.

- XM provides traders with excellent customer service, offering 24/5 customer support via live chat, email, and phone.

- XM offers a wide range of trading instruments, providing traders with access to over 1,000 tradeable instruments across global financial markets.

- XM offers a range of educational resources, including webinars, trading guides, and a trading academy, to help traders improve their skills and knowledge.

Cons

- XM’s fees for certain trading instruments, such as stocks, may be higher compared to some of its competitors.

- XM’s customer support can be slow to respond at times.

- XM’s trading platform selection can be limited for experienced traders.

Overall, the pros of XM outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, range of trading instruments, competitive trading conditions, and educational resources make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher fees in certain trading instruments and the limited platform selection for experienced traders.

XM Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Micro Account, Standard Account, XM Zero Account |

| Minimum Deposit | $5 for Micro Account and Standard Account, $100 for XM Zero Account |

| Inactivity Fee | $15 one-off maintenance fee after 90 days of inactivity, followed by a $5 monthly fee if the account remains inactive |

| Trading Fees | From $3.5 per lot |

| Spread | From 0.0 pips |

| Commission | From $3.5 per lot |

| Conversion Fee | 0.5% |

| Custody Fee | N/A |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the XM website for the most up-to-date and accurate fee information.

Conclusion

Overall, XM is a top-tier broker that offers good trading platform options, tight spreads, and excellent customer service. With its range of trading instruments, user-friendly trading platforms, and competitive trading conditions, XM is an excellent choice for both beginner and experienced traders. The broker’s trustworthiness and security make it a reliable choice for traders looking for a safe and secure trading environment. www.xm.com

10. eToro – Best Broker in UAE For Beginners

eToro is a popular online broker that offers trading and investment services to both institutional and retail clients worldwide. The broker is regulated by top-tier regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC).

Trading Platform

eToro’s trading platform is user-friendly and intuitive, making it an excellent choice for beginner traders. The platform offers a range of tools and features to help traders make informed trading decisions, including advanced charting tools, real-time news and analysis, and a range of order types to help traders execute their trades.

eToro also offers a unique social trading feature, which allows traders to follow and copy the trades of other successful traders on the platform. This feature is particularly useful for beginner traders who may not have the experience or knowledge to make informed trading decisions on their own.

Trading Instruments

eToro offers a wide range of trading instruments, including forex, CFDs, stocks, and cryptocurrencies. The broker provides traders with access to over 2,000 tradeable instruments across global financial markets.

Minimum Deposit

eToro’s minimum deposit is $50, making it an affordable choice for beginner traders who may not have a large amount of capital to invest.

Customer Support

eToro provides traders with excellent customer support, offering 24/7 customer support via live chat, email, and phone. The broker’s customer support team is knowledgeable and responsive, providing traders with the assistance they need to navigate the trading platform and make informed trading decisions.

eToro Pros and Cons

Pros

- eToro is a trusted and secure broker that is regulated by top-tier regulatory bodies, including the FCA and ASIC.

- eToro’s trading platform is user-friendly and intuitive, making it an excellent choice for beginner traders.

- eToro offers a unique social trading feature, which allows traders to follow and copy the trades of other successful traders on the platform.

- eToro offers a wide range of trading instruments, providing traders with access to over 2,000 tradeable instruments across global financial markets.

- eToro’s minimum deposit is $50, making it an affordable choice for beginner traders who may not have a large amount of capital to invest.

- eToro provides traders with excellent customer support, offering 24/7 customer support via live chat, email, and phone.

Cons

- eToro’s fees for certain trading instruments, such as cryptocurrencies, may be higher compared to some of its competitors.

- eToro’s trading platform selection can be limited for experienced traders.

- eToro’s social trading feature may encourage beginner traders to rely too heavily on other traders’ strategies without developing their own trading skills.

Overall, the pros of eToro outweigh the cons, making it an excellent choice for both beginner and experienced traders. Its trustworthiness, security, user-friendly trading platform, social trading feature, wide range of trading instruments, affordable minimum deposit, and excellent customer support make it a reliable choice for traders looking for a safe and secure trading environment. However, traders should be aware of the potential for higher fees in certain trading instruments and the limited platform selection for experienced traders.

eToro Fees

| Fee Type | Fee Amount |

|---|---|

| Account Type | Retail Account, Professional Account |

| Minimum Deposit | $50 for Retail Account, $1,000 for Professional Account |

| Inactivity Fee | $10 per month after 12 months of inactivity |

| Trading Fees | No commission on stocks, 0.75% spread on cryptocurrencies, 3 pips spread on forex |

| Conversion Fee | 0.5% |

| Withdrawal Fee | $5 |

Note that fees may vary depending on the account type and trading instrument. It is always recommended to check the eToro website for the most up-to-date and accurate fee information.

Conclusion

Overall, eToro is the best broker in UAE for beginners, providing traders with a user-friendly trading platform, a wide range of trading instruments, and excellent customer support. The broker’s social trading feature is particularly useful for beginner traders who may not have the experience or knowledge to make informed trading decisions on their own. With its affordable minimum deposit and competitive trading conditions, eToro is an excellent choice for beginner traders looking for a safe and secure trading environment. www.etoro.com

Here’s a guide to opening an account in eToro.