If you need to send money from Pakistan to the United Arab Emirates (UAE), there are several options available to you. Whether you need to send money to family or friends, pay for goods or services, or make an investment, you’ll want to find the most affordable and reliable way to do so.

One of the most important factors to consider when sending money from Pakistan to the UAE is the exchange rate. You’ll want to find the best exchange rate possible to ensure that your recipient receives the most money possible. Additionally, you’ll want to consider fees and transfer times when choosing a money transfer service.

Fortunately, there are several reputable money transfer services available that allow you to send money from Pakistan to the UAE quickly and easily. In this article, we’ll explore some of the best options available, including Western Union, Monito, and Xe Money Transfer, and provide you with the information you need to make an informed decision.

Available Options to Send Money from Pakistan to UAE

There are several options available to send money from Pakistan to UAE. Here are some of the most popular ones:

- Western Union: Western Union is a popular option for sending money from Pakistan to UAE. You can send money online, through their mobile app or by visiting one of their many agent locations in Pakistan. The recipient can receive the money in cash or directly into their bank account.

- MoneyGram: MoneyGram is another popular option for sending money from Pakistan to UAE. You can send money online or by visiting one of their agent locations in Pakistan. The recipient can receive the money in cash or directly into their bank account.

- Bank Transfer: You can also send money from your bank account in Pakistan to a bank account in UAE. This option is usually more expensive than using a money transfer service, but it can be convenient if you already have a bank account in Pakistan.

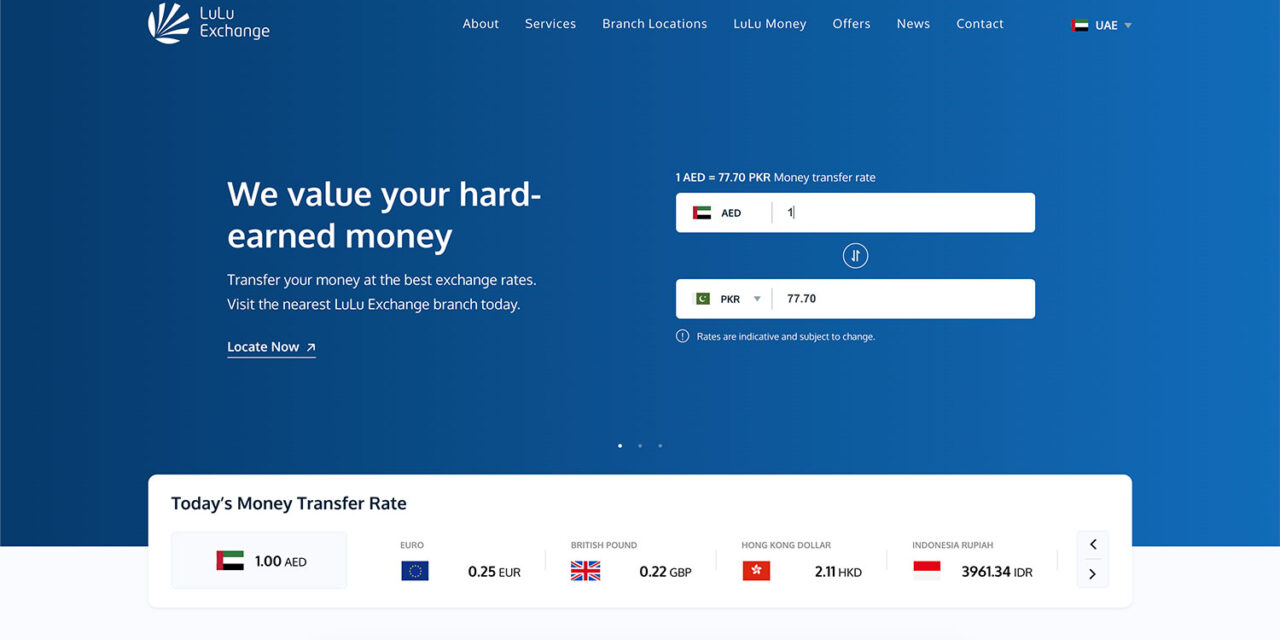

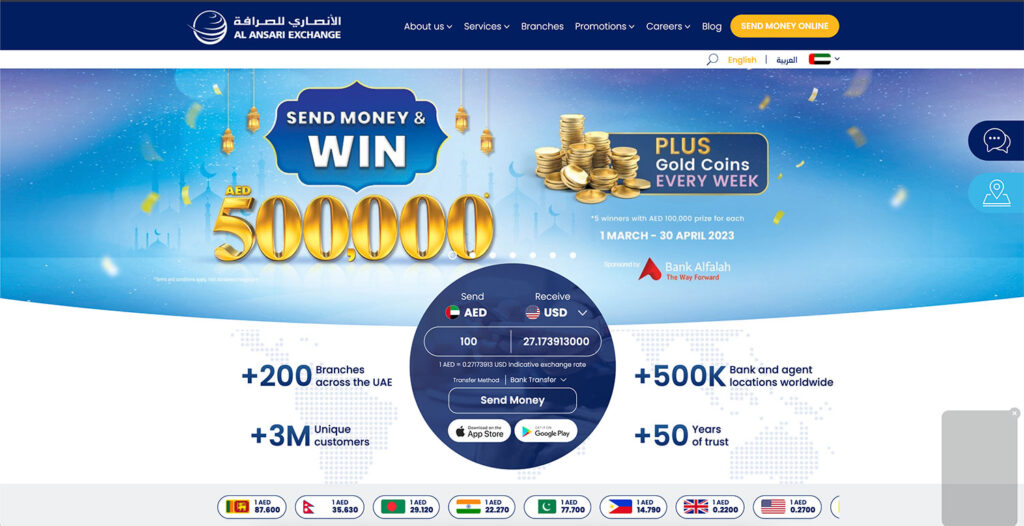

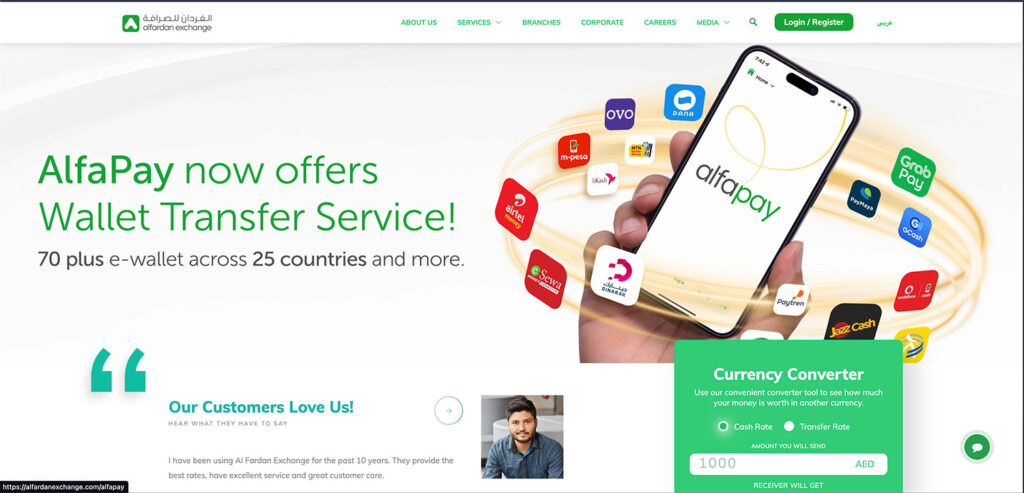

- Exchange Houses: Several exchange houses in Pakistan offer money transfer services to UAE. Some of the popular ones include Al Fardan Exchange, Al Ansari Exchange, and Lulu Exchange.

Before choosing a money transfer service, it’s important to compare the exchange rates and fees of different providers. You should also consider the transfer speed and the convenience of the service.

It’s also important to ensure that you are sending money to a legitimate recipient. Make sure that you have the correct details of the recipient, including their full name, address, and bank account details.

Additionally, you should be aware of the limits on the amount of money that you can send from Pakistan to UAE. The State Bank of Pakistan has set a limit of USD 10,000 per person per month for outward remittances.

Factors to Consider When Sending Money from Pakistan to UAE

When sending money from Pakistan to the UAE, there are several factors that you need to consider to ensure that your transaction is safe, reliable, and cost-effective. Here are some of the most important factors:

You can check conversion rates from various exchanges. Screenshot from Al Fardan Exchange website.

- Exchange Rates: Exchange rates can vary significantly between different money transfer providers. It is essential to compare exchange rates to find the best deal available. Keep in mind that exchange rates can fluctuate quickly, so it is essential to monitor them regularly.

- Fees and Commissions: Different providers charge different fees and commissions for international money transfers. Some providers may offer lower fees but higher exchange rates, while others may offer higher fees but lower exchange rates. It is crucial to compare the total cost of the transaction, including both fees and exchange rates, to find the most cost-effective option.

- Speed of Transfer: The speed of the transfer can be an essential factor, especially if you need to send money urgently. Some providers offer same-day or next-day transfers, while others may take several days to complete the transaction. Be sure to check the estimated delivery time before choosing a provider.

- Security: Security is a critical concern when it comes to international money transfers. Look for providers that offer secure online transactions and use encryption technology to protect your personal and financial information.

- Reputation: Choose a provider with a good reputation and positive customer reviews. Look for providers that are licensed and regulated by reputable financial authorities to ensure that your money is safe and secure.

- Convenience: Finally, consider the convenience of the transfer method. Some providers offer online transfers, while others may require you to visit a physical location to complete the transaction. Choose a method that is convenient for you and fits your needs.

By considering these factors, you can find the best provider for your needs and ensure a safe, reliable, and cost-effective international money transfer from Pakistan to the UAE.

Steps to send money from Pakistan to UAE

If you need to send money from Pakistan to UAE, there are several options available to you. Below are the general steps to follow:

- Choose a money transfer service: You can choose from a variety of money transfer services available online and offline. Make sure to choose one that is reliable, secure, and offers competitive exchange rates.

- Register with the service: Once you have selected a money transfer service, you will need to register with them. This typically involves providing your personal information and verifying your identity.

- Enter the details of the transfer: You will need to provide the recipient’s details, including their name, address, and bank account information. Make sure to double-check all the details before submitting the transfer.

- Choose the payment method: You can choose to pay for the transfer using a bank transfer, credit/debit card, or cash. The fees and processing times may vary depending on the payment method you choose.

- Confirm the transfer: Once you have entered all the details and chosen the payment method, you will need to confirm the transfer. Review all the details one last time before submitting the transfer.

- Track the transfer: Most money transfer services offer the option to track your transfer online or through their mobile app. This allows you to monitor the status of the transfer and ensure that it has been successfully completed.

It is important to note that the specific steps may vary depending on the money transfer service you choose. Make sure to read the instructions carefully and follow them closely to ensure a smooth and hassle-free transfer.

Conclusion

Sending money from Pakistan to UAE can be a straightforward process if you choose the right method. With a variety of options available, you can choose the one that best suits your needs and budget.

If you need to send money quickly, using a money transfer service like Al Ansari Exchange or HSBC UAE can be a good option. These services offer fast transfers and competitive exchange rates, but they may charge higher fees compared to other options.

On the other hand, if you have more time and want to save on fees, using a bank transfer can be a good choice. Many banks in the UAE offer this service, and it can be a cost-effective way to send money to Pakistan.

Before choosing a method, make sure to compare the fees, exchange rates, and transfer times of different providers. This will help you find the best option for your needs and budget.

Overall, sending money from Pakistan to UAE is easy and convenient, as long as you choose the right method. By doing your research and comparing different providers, you can save money and ensure your transfer arrives safely and quickly.