Forex trading has become increasingly popular in the United Arab Emirates (UAE) due to its potential to generate significant profits. However, before you start trading, it is essential to understand the basics of forex trading and the steps involved in opening an account. In this article, we will provide a step-by-step guide on how to open a forex account in UAE and start trading.

The first step to trading forex in the UAE is to choose a reputable broker. There are numerous brokers available, so it is crucial to do your research and select a broker that is regulated by the UAE Central Bank. Once you have chosen a broker, the next step is to open an account.

Opening a forex account in the UAE is a straightforward process. Most brokers offer an online account opening process that takes only a few minutes to complete. You will need to provide personal information, including your name, address, and contact details. Additionally, you will need to provide identification documents, such as a passport or Emirates ID, to verify your identity.

Understanding Forex Trading

What is Forex Trading?

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies with the aim of making a profit. The forex market is the largest financial market in the world, with a daily turnover of over $5 trillion. Forex trading involves speculating on the price movements of currency pairs, such as the USD/EUR or the GBP/USD. Traders can either buy or sell a currency pair, depending on whether they believe the value will increase or decrease.

Why Trade Forex in the UAE?

The UAE is an ideal location for forex trading due to its strategic location between Asia and Europe, as well as its stable political and economic environment. The country has a well-regulated financial market, with the Securities and Commodities Authority (SCA) overseeing all forex brokers. Additionally, the absence of income tax and low trading fees make the UAE an attractive destination for traders looking to maximize their profits.

Forex Trading Risks

While forex trading can be a lucrative investment opportunity, it also comes with a number of risks. The most significant risk is the volatility of the forex market, which can lead to sudden and significant price movements. Traders must also be aware of the impact of leverage, which can amplify both profits and losses. It is important for traders to have a solid understanding of market analysis and risk management strategies to minimize their exposure to potential losses. Overall, forex trading in the UAE offers a unique opportunity for traders looking to take advantage of the growing financial market in the region. However, it is important for traders to approach forex trading with caution and a thorough understanding of the risks involved.

Selecting a Forex Broker

Regulation and Licensing

One of the most important factors to consider when selecting a forex broker is regulation and licensing. Forex brokers operating in the UAE must be licensed by the Dubai Financial Services Authority (DFSA) or the Central Bank of the UAE (CBUAE).

Make sure to check the regulatory status of the broker you are considering. A regulated broker offers a higher level of security for your funds and ensures that the broker operates according to strict guidelines and regulations.

Trading Platform

The trading platform is the software that you will use to execute trades and manage your account. A good trading platform should be user-friendly, stable, and offer a wide range of trading tools and features.

Before selecting a forex broker, make sure to test their trading platform. Many brokers offer demo accounts that allow you to try out their platform with virtual funds. This can help you determine if the platform meets your needs and preferences.

Account Types

Forex brokers offer different types of accounts to suit the needs of different traders. Some brokers offer basic accounts with low minimum deposits, while others offer premium accounts with additional features and benefits.

Consider your trading goals and preferences when selecting an account type. If you are new to forex trading, a basic account with a low minimum deposit may be a good option. If you are an experienced trader, a premium account with additional features and benefits may be more suitable.

Deposit and Withdrawal Methods

Forex brokers offer different deposit and withdrawal methods, such as bank transfers, credit cards, and e-wallets. Make sure to check the deposit and withdrawal options offered by the broker you are considering.

Consider the fees and processing times associated with each payment method. Some methods may be faster and more convenient, but may also come with higher fees.

Overall, selecting a forex broker is an important decision that should be made carefully. Consider the factors discussed in this section and do your research before making a decision.

Opening a Forex Trading Account

Documents Required

Before opening a forex trading account in the UAE, you need to make sure you have the necessary documents. The documents required may vary depending on the broker, but typically you will need to provide:

- Proof of identity (passport, Emirates ID, or driver’s license)

- Proof of residency (utility bill or bank statement with your name and address)

- Bank account details (for funding your account and withdrawing profits)

Account Registration Process

The process of opening a forex trading account in the UAE is quite straightforward. You will need to follow these steps:

- Choose a regulated broker that suits your needs and preferences.

- Visit the broker’s website and click on the “Open Account” or “Register” button.

- Fill in the registration form with your personal details, such as your name, email address, and phone number.

- Choose the account type that best suits your trading style and risk appetite.

- Read and agree to the broker’s terms and conditions.

- Submit the registration form and wait for the broker to approve your account.

Account Verification

After you have registered your forex trading account, you will need to verify your identity and residency. This is a mandatory requirement by UAE regulators to prevent money laundering and fraud. The verification process may take longer than the account registration process, but it is necessary to ensure the safety and security of your funds and personal information.

The broker will typically ask you to provide at least two documents to verify your identity and residency. These documents may include:

- Passport or Emirates ID

- Utility bill or bank statement

- Proof of income or employment

Once your account has been verified, you can fund it and start trading forex. Make sure to read and understand the broker’s trading conditions, fees, and risks before placing any trades. It is also recommended to start with a demo account to practice your trading skills and strategies before risking real money.

Fund Your Trading Account

Now that you have chosen a broker and opened a trading account, the next step is to fund your account. This is a crucial step as it determines your ability to trade in the forex market. In this section, we will discuss the different deposit options and currency exchange rates available when funding your trading account in the UAE.

Deposit Options

Brokers typically offer several deposit options, including bank transfers, credit/debit cards, and e-wallets. Bank transfers are a popular option as they are secure and have no deposit limits. However, they can take several days to process. Credit/debit cards and e-wallets, on the other hand, are faster but may have deposit limits and fees.

It is important to note that some brokers may only accept deposits in certain currencies. Therefore, it is advisable to check with your broker before making a deposit to avoid any currency conversion fees.

Currency Exchange Rates

Currency exchange rates are a crucial factor to consider when funding your trading account. Brokers may charge a fee or offer a less favorable exchange rate when converting your deposit into the account currency. Therefore, it is important to compare exchange rates and fees offered by different brokers to ensure you get the best deal.

Additionally, some brokers offer multi-currency accounts, which allow you to hold funds in different currencies. This can be beneficial if you trade in different markets or want to avoid currency conversion fees.

In conclusion, funding your trading account is a crucial step in forex trading. It is important to choose a deposit option and currency exchange rate that is cost-effective and convenient for you. By doing so, you can start trading with confidence and ease.

Start Trading Forex

Now that you have opened a forex account in the UAE, it’s time to start trading. Here are some important steps to consider:

Forex Trading Strategies

It’s important to have a strategy in place before you start trading. There are several trading strategies to choose from, including:

- Day trading

- Swing trading

- Position trading

- Scalping

Choose a strategy that aligns with your goals, risk tolerance, and trading style. It’s also important to backtest your strategy and practice on a demo account before trading with real money.

Risk Management

Forex trading involves risk, and it’s important to have a risk management plan in place. Here are some tips:

- Set stop-loss orders to limit your losses

- Use proper position sizing to manage risk

- Avoid overtrading and stick to your strategy

Remember, risk management is key to long-term success in forex trading.

Monitoring and Analysis Tools

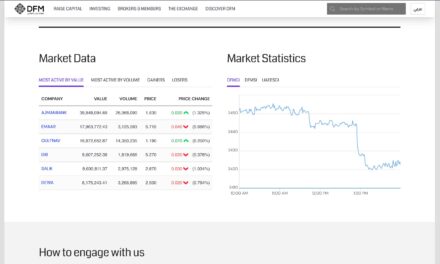

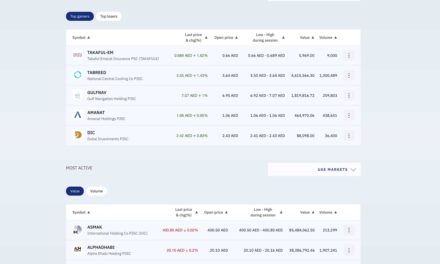

There are several tools and resources available to help you monitor the forex market and analyze price movements. Here are some examples:

- Forex charts and technical indicators

- Economic calendars and news feeds

- Trading journals and performance tracking tools

Using these tools can help you make informed trading decisions and stay up-to-date on market developments.