Dubai has launched a new savings scheme for expat employees who work in the public sector. The scheme is the first of its kind in the region and aims to provide employees with an additional layer of financial security. The savings scheme is designed to enhance the end-of-service benefits system, which is already in place for non-Emirati employees working in Dubai’s government and public sector.

The new savings pension plan will take effect from July 1st, 2022, and will be supervised by the Dubai International Financial Centre (DIFC). The employer will contribute the total end-of-service gratuity to the plan from the date of joining, without including the financial dues for previous years of service. The percentage of the contribution to the scheme will equal the end-of-service gratuity, and the employee can also make voluntary contributions to the scheme.

The savings scheme is a significant step towards providing financial security to foreign employees working in Dubai’s public sector. The scheme will ensure that employees have a financial cushion when they retire or leave their job. It will also provide employees with an additional incentive to work in Dubai’s public sector and contribute to the growth of the city.

Overview of the Savings Scheme

The Savings Scheme for Foreign Employees in the Government of Dubai is a voluntary scheme that was launched in March 2022 by the Executive Council of Dubai and approved by Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, the Crown Prince of Dubai and Chairman of the Executive Council. The scheme aims to enhance the end-of-service benefits system for foreign employees in the Dubai government and provide them with saving opportunities.

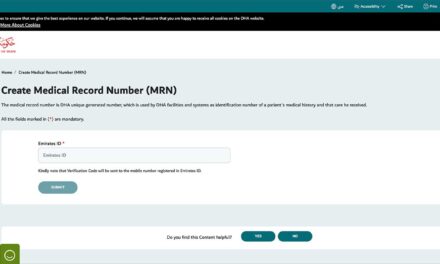

Enrolment Process

The enrolment process for the Savings Scheme for Foreign Employees in the Government of Dubai is simple and straightforward. Foreign employees who are eligible can enrol in the scheme on a voluntary basis, and the enrolment process is managed by the Dubai International Financial Centre (DIFC) in partnership with several government entities, including the Department of Finance, the General Secretariat of the Executive Council of Dubai, and the Board of Trustees of the Dubai Government Employee End of Service Benefits Fund.

Contributions

The Savings Scheme for Foreign Employees in the Government of Dubai requires a minimum contribution of 5% of the employee’s basic salary, which can be increased up to 15% at the discretion of the employee. The contributions are deducted from the employee’s salary on a monthly basis and are deposited into the employee’s individual account in the scheme.

Investment Structures

The Savings Scheme for Foreign Employees in the Government of Dubai offers a range of investment structures to suit the needs and preferences of the employees. The investment structures are designed to provide capital protection and generate returns on the employee’s contributions. The investment structures include various financial portfolios, including equity, fixed income, and balanced portfolios, and are managed by the DIFC in adherence to Islamic Sharia principles.

In conclusion, the Savings Scheme for Foreign Employees in the Government of Dubai provides foreign employees with an integrated system for end-of-service benefits and saving opportunities. The scheme is managed by the DIFC in partnership with several government entities and offers a range of investment structures to suit the needs and preferences of the employees.

Benefits of the Savings Scheme

The Savings Scheme for Foreign Employees in the Government of Dubai has numerous benefits for expatriates working in the government sector. The scheme aims to enhance the end-of-service benefits system, ensuring financial sustainability and social stability for employees.

End-of-Service Benefits

The scheme provides a savings pension plan that replaces the traditional end-of-service gratuity system. This plan ensures that non-Emirati employees receive their end-of-service dues in a timely and efficient manner, in accordance with the UAE labour law. The savings pension plan also guarantees a higher rate of return on investment portfolios, ensuring financial liquidity for employees after retirement.

Financial Sustainability

The Savings Scheme for Foreign Employees in the Government of Dubai provides financial sustainability for employees, ensuring they have a high quality of life during and after their employment. The scheme is designed to provide financial contributions to employees based on their job grades, ensuring that they are promoted based on their performance and earning potential.

Social Stability

The scheme also provides social stability for employees, ensuring that they are able to maintain their standard of living after retirement. The scheme is governed by a supervisory board that ensures the governance system is in line with global best practices. The scheme also offers Islamic Shariah compliant portfolios, ensuring that employees who prefer Shariah compliant investments have the opportunity to invest in them.

Savings Opportunities

The Savings Scheme for Foreign Employees in the Government of Dubai provides savings opportunities for employees, ensuring that they have access to a range of investment portfolios. The scheme offers three investment portfolios: Capital Protection Portfolio, Medium-risk Portfolio, and High-risk Portfolio. The scheme also provides a salary guide that helps employees plan their savings and investments.

In summary, the Savings Scheme for Foreign Employees in the Government of Dubai provides numerous benefits for employees, ensuring financial sustainability and social stability. The scheme is designed in accordance with international best practices, ensuring that employees have access to a range of investment portfolios and savings opportunities. The scheme is a positive step towards ensuring the well-being of employees in the government entities of Dubai.

Implementation of the Savings Scheme

The Savings Scheme for Foreign Employees in the Government of Dubai is a tailor-made and proven solution that aims to enhance the end-of-service benefits system. The Scheme is supervised by the Dubai International Financial Centre (DIFC) in partnership with several reputable companies such as Equiom, Zurich Workplace Solutions, and Mercer.

Roadmap

The Steering Committee of the Savings Scheme for Foreign Employees in the Government of Dubai has held its first meeting to discuss the action plan for enrolling foreign employees into the Savings Scheme, along with other implementation mechanisms. The new enrolment and implementation mechanisms will ensure that employees are protected and provided with opportunities to develop their savings and end-of-service dues. The Scheme will be gradually rolled out to cover all foreign employees in the Dubai Government.

Supervision

The DIFC will supervise the Savings Scheme for Foreign Employees in the Government of Dubai to ensure that it is a sustainable system that provides long-term benefits for employees. The DIFC will also ensure that the Scheme complies with all relevant regulations and laws. Abdulla Al Basti, Secretary-General of the Executive Council of Dubai, has emphasized the importance of the Scheme in protecting the rights of foreign employees and providing them with opportunities to develop their savings and end-of-service dues.

Investment Management

Equiom, Zurich Workplace Solutions, and Mercer will provide investment management services for the Savings Scheme for Foreign Employees in the Government of Dubai. These companies will ensure that the Scheme’s investments are diversified, well-managed, and provide long-term benefits for employees. The investment management services will be transparent and in compliance with all relevant regulations and laws.

Overall, the implementation of the Savings Scheme for Foreign Employees in the Government of Dubai is a significant step towards enhancing the end-of-service benefits system for foreign employees. The Scheme’s sustainable system, supervision by the DIFC, and investment management services by reputable companies such as Equiom, Zurich Workplace Solutions, and Mercer will ensure that employees are protected and provided with opportunities to develop their savings and end-of-service dues.

Integration with Other Government Initiatives

The Savings Scheme for Foreign Employees in the Government of Dubai is part of a larger effort by the government to create a more sustainable and integrated system that protects employees’ rights and attracts and retains talent. To achieve this, the scheme is being integrated with other government initiatives, including the Traffic Safety Strategy and Dubai Plan 2021.

Traffic Safety Strategy

The Traffic Safety Strategy is a comprehensive plan to reduce the number of road accidents and fatalities in Dubai. The plan includes a range of initiatives, such as improving traffic control, vehicle and highway engineering, and traffic awareness. The Roads and Transport Authority and Dubai Police Headquarters are the main entities responsible for implementing the plan.

The integration of the Savings Scheme with the Traffic Safety Strategy is aimed at creating a more holistic approach to employee welfare. By providing employees with savings opportunities, the scheme can help reduce financial stress and improve their overall well-being, which in turn can lead to better road safety outcomes.

Dubai Plan 2021

Dubai Plan 2021 is a long-term development plan that aims to make Dubai one of the world’s best cities to live in. The plan includes a range of initiatives, such as improving healthcare, education, and infrastructure, and creating a more sustainable and connected city. The plan is part of the National Agenda, which aims to achieve sustainable development and improve the quality of life for UAE citizens and residents.

The integration of the Savings Scheme with Dubai Plan 2021 is aimed at creating a more sustainable and integrated system that protects employees’ rights and attracts and retains talent. By providing employees with savings opportunities, the scheme can help improve their financial well-being, which in turn can lead to a more sustainable and connected city.

Frequently Asked Questions

What are the benefits of the savings scheme for foreign employees in Dubai?

The savings scheme for foreign employees in Dubai provides a secure and reliable way for employees to save for their end-of-service benefits. This scheme also offers multiple investment options, which allows employees to choose investment avenues that suit their financial goals and risk appetite. Additionally, the savings scheme is portable, which means that if employees leave their jobs, they can still retain their savings and continue to contribute to the scheme.

How can I enroll in a savings scheme as a foreign employee in Dubai?

To enroll in the savings scheme, foreign employees in Dubai must first check if their employer is participating in the scheme. If their employer is participating, employees can enroll by filling out the necessary forms and providing the required documentation.

What is the maximum contribution limit for the savings scheme for foreign employees in Dubai?

The maximum contribution limit for the savings scheme for foreign employees in Dubai is 5% of the employee’s basic salary. However, employers may choose to contribute more than the minimum required amount.

Are there any tax benefits for participating in the savings scheme for foreign employees in Dubai?

There are currently no tax benefits for participating in the savings scheme for foreign employees in Dubai. However, employees can enjoy the benefits of compounding interest and potential investment gains.

What investment options are available in the savings scheme for foreign employees in Dubai?

The savings scheme for foreign employees in Dubai offers multiple investment options, including equity funds, fixed income funds, and balanced funds. Employees can choose to invest in one or more of these options based on their financial goals and risk appetite.

Is the savings scheme for foreign employees in Dubai portable if I leave my job?

Yes, the savings scheme for foreign employees in Dubai is portable. If employees leave their jobs, they can still retain their savings and continue to contribute to the scheme. However, employees must ensure that they meet the necessary requirements and comply with the relevant regulations to ensure that their savings remain secure and accessible.