Flexible Payment Options for Gold: Easy Installment Plans in the UAE

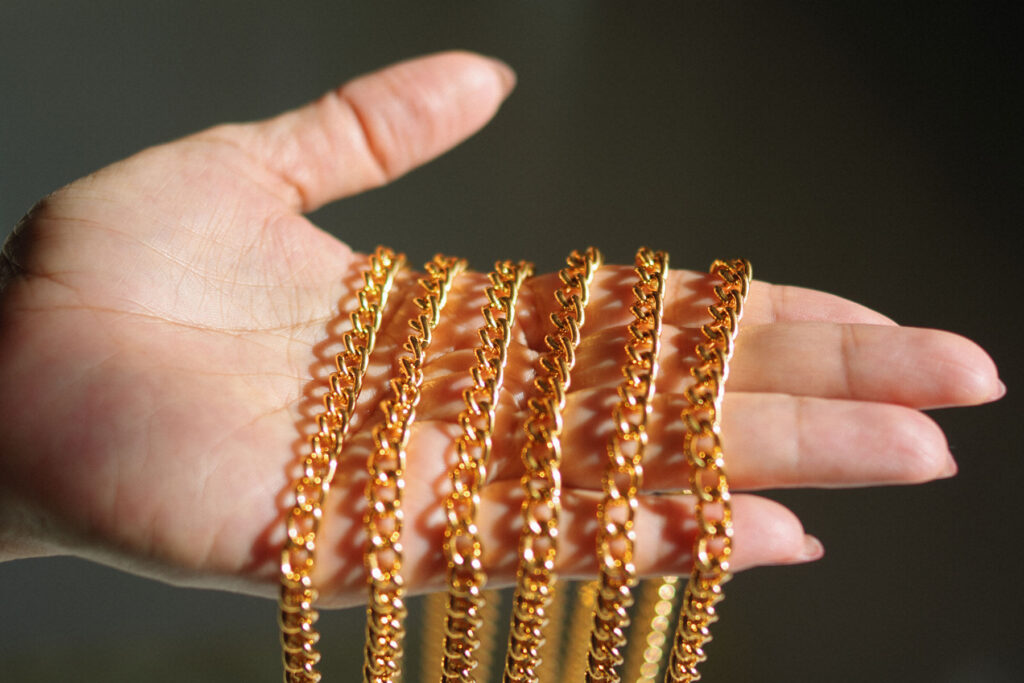

Gold on Credit – gold has a significant presence in the UAE’s economy and culture. Dubai, in particular, is known as a hub for the global gold trade, with a rich history of gold trading and manufacturing dating back centuries.

The UAE is home to numerous gold markets and souks, including the famous Gold Souk in Dubai, which is one of the largest gold markets in the world. The souk features hundreds of gold shops, with a wide variety of gold jewelry, coins, and other products available for sale.

In addition to traditional gold markets, the UAE also has a thriving online gold market, with a number of online retailers offering gold products for sale. These retailers offer a range of products, including gold coins, bars, and jewelry, and often provide competitive prices and convenient delivery options.

In recent years, the UAE has also become a hub for the global gold refining industry, with several refineries located in Dubai and other parts of the country. These refineries process gold ore and scrap metal from around the world, and produce high-quality gold products that are sold domestically and internationally.

Overall, gold is an important part of the UAE’s economy and culture, with a long history of gold trading and manufacturing in the region. The UAE’s reputation as a hub for the global gold trade continues to attract investors and traders from around the world.

- Dubai is one of the largest gold trading centers in the world, with an estimated 40% of global physical gold traded through the city’s gold markets and refineries.

- The Dubai Gold and Commodities Exchange (DGCX) is a major player in the global gold futures market, offering a range of gold contracts for trading.

- The UAE is home to several large gold refineries, including the Emirates Gold Refinery, Kaloti Precious Metals, and the Dubai Multi Commodities Centre (DMCC) refinery.

- Gold is exempt from value-added tax (VAT) in the UAE, making it an attractive destination for gold buyers and traders.

- The Dubai Gold Souk, located in the heart of Dubai’s old town, is a traditional market that offers a wide range of gold jewelry, bullion, and coins.

- The Abu Dhabi Securities Exchange (ADX) launched a gold exchange-traded fund (ETF) in 2017, providing investors with exposure to physical gold through a listed security.

- The UAE Central Bank also holds a significant amount of gold reserves, with

an estimated 30 tonnes of gold held as of 2021.

The UAE’s gold industry is a major contributor to the country’s economy and has helped establish Dubai as a leading global hub for gold trading and refining.

Buy Gold on Installment Plan

You can buy gold on installment even if you don’t have a credit card or prefer not to use one. In the UAE, there are several options available for customers who want to purchase gold on installment.

One of the most popular options is to use a buy now, pay later platform such as Spotii or PostPay. These platforms allow customers to buy gold and pay for it in installments without having to use a credit card. Customers can choose from various payment options, including bank transfers, cash on delivery, and other payment methods that suit their needs.

Buy now, pay later is a payment option that allows customers to purchase goods or services and pay for them in installments over a period of time, rather than paying the full amount upfront. This payment option has become increasingly popular in recent years, particularly in the e-commerce industry.

When a customer chooses to buy now, pay later, they typically make a small initial payment, often around 25% of the total purchase price, and then pay the remaining balance in equal installments over several weeks or months. Some buy now, pay later providers may also charge interest or fees on the installments, while others offer interest-free payment plans.

Buy now, pay later options are often provided by third-party payment providers, who work with retailers to offer customers flexible payment options. These payment providers typically use advanced algorithms to assess the creditworthiness of customers, allowing them to make quick decisions on whether to approve or reject a purchase.

The benefits of buy now, pay later include greater flexibility for customers, as they can make purchases without having to pay the full amount upfront. It also allows customers to manage their cash flow more effectively, particularly for larger purchases. However, it’s important for customers to carefully review the terms and conditions of any buy now, pay later payment plan before signing up, to ensure that they understand the full cost and any associated fees or charges.

It’s important to note that when purchasing gold on installment, customers should be aware of the terms and conditions of the payment plan, including any interest or fees that may be charged. It’s also important to purchase gold from a reputable store that provides high-quality gold and fair pricing.

Here are lists of platform you can use to buy gold on installment without credit card.

1. Cashew Payments

Cashew Payments is a leading buy now, pay later platform that makes it easy for businesses to offer flexible payment options to their customers. Our platform provides a range of features designed to ensure a seamless buying experience.

With Cashew Payments, customers can make purchases and pay for them in installments, without having to pay any interest fees. This means they can get the products or services they need, while still managing their cash flow effectively.

Key Features

- Global payments platform: Cashew Payments is a global payments platform that supports transactions in multiple currencies and payment methods.

- Payment methods: Customers can pay using various payment methods such as credit and debit cards, bank transfers, and e-wallets.

- Customizable payment solutions: Cashew Payments offers customizable payment solutions for businesses, including invoicing, payment links, and checkout integrations.

- Risk management and fraud prevention: The platform provides a range of risk management and fraud prevention tools, including 3D Secure, fraud monitoring, and chargeback protection.

- Multi-currency accounts: Cashew Payments offers multi-currency accounts and forex services to enable businesses to receive and manage payments in different currencies.

- User-friendly interface: The platform is user-friendly, making it easy for customers to make transactions and manage their accounts.

- 24/7 support: Cashew Payments provides 24/7 support to its customers through various channels, including email, phone, and live chat.

- Compliance: Cashew Payments is compliant with various industry standards and regulations, including PCI DSS and GDPR.

Qualifications and Eligibility

Qualifications:

• At least 21 years old

• Emirates ID

• Phone Number

• Email Address

• Debit / Credit card issued in the UAE

Installment option

• Pay installments in 2-week period

• Divide total cost into three equal monthly installments

Cashew Payments provides a comprehensive payments platform that caters to the needs of businesses, merchants, and individuals. Its range of features makes it a viable option for customers across different industries and regions.

Call +971 4 562 6011

Email support@cashewpayments.com

www.cashewpayments.com

2. Tabby

Tabby is a buy now, pay later platform that allows customers to make purchases and pay for them in installments, without any interest or hidden charges. With a seamless integration with retailers, Tabby offers a simple and hassle-free payment option. Plus, Tabby is committed to providing a secure and transparent buying experience, with 24/7 customer support available to assist customers.

Key features:

- Buy now, pay later: Tabby Payments allows customers to buy now and pay later in instalments, making it easy for them to make purchases without having to pay the full amount upfront.

- Interest-free payments: Tabby Payments offers interest-free payments to customers, which means they only have to pay the purchase amount and no additional interest fees.

- Multiple payment options: Tabby Payments supports various payment options, including credit and debit cards, bank transfers, and cash on delivery.

- Customizable payment plans: Tabby Payments provides customizable payment plans that businesses can offer to their customers, allowing them to choose the payment plan that works best for them.

- Instant approvals: Customers can get instant approvals for their purchases through the Tabby Payments platform, making the buying process fast and convenient.

- Easy integration: Tabby Payments can be easily integrated into a business’s existing website or e-commerce platform, providing a seamless buying experience for customers.

- 24/7 customer support: Tabby Payments provides 24/7 customer support to its users, ensuring that any issues or concerns are promptly addressed.

- Fraud prevention: Tabby Payments uses advanced fraud prevention technology to protect its users from fraudulent transactions.

Qualifications and Eligibility

Qualifications

• 18 years old

• Emirates ID

• Good credit history

Installment options

• 25% upon purchase

• 25% in one month

• 25% in two month

• 25% in three month

Tabby Payments provides a comprehensive buy now, pay later platform that caters to the needs of businesses and customers in the Middle East region. Its range of features makes it a viable option for businesses looking to offer flexible payment options to their customers.

www.tabby.ai

3. Tamara

Tamara is a buy now, pay later platform that allows you to make purchases and pay for them in instalments, without having to worry about interest fees or hidden charges. Our platform is designed to make the buying process simple and hassle-free, so you can focus on getting the products and services you need.

Tamara is also committed to providing a secure and transparent buying experience. Our platform uses advanced fraud detection and risk management tools, ensuring that your purchases are always safe and secure. We also offer 24/7 customer support, so you can get help whenever you need it.

Key features:

- Buy now, pay later: Tamara allows customers to buy now and pay later in instalments, making it easy for them to make purchases without having to pay the full amount upfront.

- Interest-free payments: Tamara offers interest-free payments to customers, which means they only have to pay the purchase amount and no additional interest fees.

- Multiple payment options: Tamara supports various payment options, including credit and debit cards, bank transfers, and cash on delivery.

- Customizable payment plans: Tamara provides customizable payment plans that businesses can offer to their customers, allowing them to choose the payment plan that works best for them.

- Instant approvals: Customers can get instant approvals for their purchases through the Tamara platform, making the buying process fast and convenient.

- Easy integration: Tamara can be easily integrated into a business’s existing website or e-commerce platform, providing a seamless buying experience for customers.

- 24/7 customer support: Tamara provides 24/7 customer support to its users, ensuring that any issues or concerns are promptly addressed.

- No hidden fees: Tamara does not charge any hidden fees or penalties, providing customers with transparent pricing and no surprises.

- Referral program: Tamara offers a referral program where customers can refer their friends and earn cashback rewards.

Qualifications and Eligibility

Qualifications

• Must be at least 18 years old

• Resident of UAE, Saudi or Kuwait

Installments Options

• Three installment payments over a 60-day period

• Full payment after 30 days without incurring any costs

Tamara provides a comprehensive buy now, pay later platform that caters to the needs of businesses and customers in the Middle East region. Its range of features makes it a viable option for businesses looking to offer flexible payment options to their customers.

www.tamara.co

4. Spotii

Spotii is a buy now, pay later platform that allows customers to make purchases and pay for them in instalments with zero interest fees. With a quick and easy sign-up process, Spotii offers a flexible payment option for customers across a range of industries, from fashion to home goods. Plus, Spotii is committed to providing a secure and transparent buying experience, with 24/7 customer support available to help with any issues.

Key features:

- Buy now, pay later: Spotii allows customers to buy now and pay later in installments, making it easy for them to make purchases without having to pay the full amount upfront.

- Interest-free payments: Spotii offers interest-free payments to customers, which means they only have to pay the purchase amount and no additional interest fees.

- Multiple payment options: Spotii supports various payment options, including credit and debit cards, bank transfers, and cash on delivery.

- Customizable payment plans: Spotii provides customizable payment plans that businesses can offer to their customers, allowing them to choose the payment plan that works best for them.

- Instant approvals: Customers can get instant approvals for their purchases through the Spotii platform, making the buying process fast and convenient.

- Easy integration: Spotii can be easily integrated into a business’s existing website or e-commerce platform, providing a seamless buying experience for customers.

- 24/7 customer support: Spotii provides 24/7 customer support to its users, ensuring that any issues or concerns are promptly addressed.

- No hidden fees: Spotii does not charge any hidden fees or penalties, providing customers with transparent pricing and no surprises.

- Referral program: Spotii offers a referral program where customers can refer their friends and earn cashback rewards.

- Flexible payment schedules: Spotii allows customers to choose flexible payment schedules, including weekly, bi-weekly, and monthly payment options.

Qualifications and Eligibility

Qualifications

18 years old

UAE Phone number

Valid email address

Installment Option

4 installments, the first payment is made upon purchase

Spotii provides a comprehensive buy now, pay later platform that caters to the needs of businesses and customers in the Middle East region. Its range of features makes it a viable option for businesses looking to offer flexible payment options to their customers.

Call +971 4 275 3550

www.spotii.com

5. PostPay

Postpay is a buy now, pay later platform that offers interest-free payment plans for online purchases. With a quick sign-up process and flexible payment options, Postpay is a convenient solution for customers looking to spread out the cost of their purchases. Plus, Postpay is committed to providing a transparent buying experience, with no hidden fees or charges.

Key features:

- Buy now, pay later: PostPay allows customers to buy now and pay later in installments, making it easy for them to make purchases without having to pay the full amount upfront.

- Interest-free payments: PostPay offers interest-free payments to customers, which means they only have to pay the purchase amount and no additional interest fees.

- Multiple payment options: PostPay supports various payment options, including credit and debit cards, bank transfers, and cash on delivery.

- Customizable payment plans: PostPay provides customizable payment plans that businesses can offer to their customers, allowing them to choose the payment plan that works best for them.

- Instant approvals: Customers can get instant approvals for their purchases through the PostPay platform, making the buying process fast and convenient.

- Easy integration: PostPay can be easily integrated into a business’s existing website or e-commerce platform, providing a seamless buying experience for customers.

- 24/7 customer support: PostPay provides 24/7 customer support to its users, ensuring that any issues or concerns are promptly addressed.

- No hidden fees: PostPay does not charge any hidden fees or penalties, providing customers with transparent pricing and no surprises.

- Cashback rewards: PostPay offers cashback rewards to customers who make timely payments, incentivizing them to pay on time.

- Credit scoring: PostPay uses advanced credit scoring technology to assess the creditworthiness of customers, ensuring that businesses are protected against fraudulent transactions.

Qualifications and Eligibility

Qualifications

• At least 18 years old

• Emirates ID

• UAE Mobile Number

• Debit / credit card issued in the UAE

Installment Options

• Two payments

– one half payment upon purchase, and half in succeeding month

• Four installments

– to be paid every two week or monthly without interest

PostPay provides a comprehensive buy now, pay later platform that caters to the needs of businesses and customers in the Middle East region. Its range of features makes it a viable option for businesses looking to offer flexible payment options to their customers.

Call +971 4 215 6555

Email support@postpay.io

www.postpay.io